Illinois Sues State Farm Over Homeowners Insurance Policies: Key Details

Illinois Attorney General Kwame Raoul has initiated a lawsuit against State Farm over its homeowners insurance policies. This action follows substantial increases in home insurance rates within the state.

Context of the Lawsuit Against State Farm

The lawsuit, filed in Springfield, calls for State Farm to provide detailed data regarding its homeowners insurance policies at the zip-code level. This request aims to assist Illinois officials in evaluating the pressing issues within the homeowners insurance market, which have significantly affected residents.

Recent Rate Increases

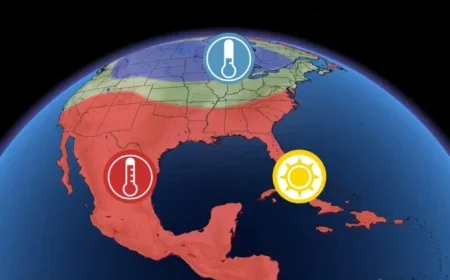

In July, State Farm announced an average increase of 27.2% in home insurance rates. The company attributed these hikes to rising home replacement costs and an increase in severe weather events, which have led to more frequent and costly claims.

Statements from State Officials

Governor JB Pritzker has criticized these rate increases as “unfair and arbitrary.” He argued that State Farm’s justification for such hikes does not align with available state data. Pritzker urged lawmakers to implement regulations preventing such excessive rate increases.

Details of the Attorney General’s Complaint

- Raoul’s lawsuit seeks comprehensive data on State Farm’s insurance practices and market conditions.

- The request follows an investigation by the Illinois Department of Insurance (IDOI) that began in November 2024.

Legal Context

Current Illinois law requires insurance companies to file their rates with the IDOI. However, the state lacks provisions to reject rates deemed inadequate or excessively high, making it unique in the U.S.

State Farm’s Response

A representative for State Farm, Gina Morss-Fischer, claimed that the lawsuit lacks merit. She stated that the company’s actions comply with legal requirements and emphasized their dedication to collaborating with the Illinois Department of Insurance.

Implications for Illinois Residents

The outcomes of this lawsuit may have significant implications for homeowners in Illinois. If the state successfully obtains the requested data, it could provide insights into whether such increases are justified.

As this case unfolds, it will be crucial to monitor how it affects homeowners insurance rates and the broader insurance market in Illinois.