Top Investor Highlights Risks in Tesla Stock Despite Optimism

Tesla, Inc. (NASDAQ: TSLA) is experiencing heightened interest as its Q3 2025 earnings report approaches this Wednesday. This report comes after a significant recovery for the company, which faced challenges earlier in the year.

Tesla’s Impressive Q3 Deliveries

In Q3, Tesla recorded a remarkable 497,099 deliveries, setting a new company record. This figure marks a turnaround from previous quarters, which had been characterized by declining year-over-year delivery numbers. CEO Elon Musk’s leadership remains central to the company’s renewed momentum, particularly as he navigates a potential compensation package estimated at around $1 trillion.

Financial Expectations and Market Sentiment

Analysts anticipate Q3 revenues to reach approximately $26.58 billion, with a normalized earnings per share (EPS) figure of $0.55. These projections reflect expected sequential gains for the company. As of now, Tesla’s stock has surged over 90% in the last six months, recovering from earlier declines.

Investor Insights on Tesla Stock Risks

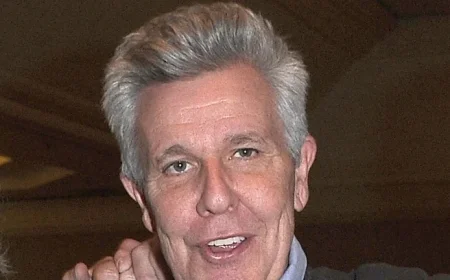

Victor Dergunov, a top investor and member of the elite 3% of stock analysts on TipRanks, has expressed a bullish outlook on Tesla. Despite recognizing several risks—including increasing EV competition and challenges in AI monetization—Dergunov upgraded Tesla’s stock rating to a Strong Buy.

- Key factors for the upgrade include Elon Musk’s strong commitment and record EV deliveries.

- Dergunov is encouraged by Musk’s recent $1 billion stock purchase and the upcoming Model Y refresh.

Price Target Predictions

Dergunov suggests that Tesla’s Q3 revenues might even surpass $29 billion. He has set a 12-month price target of $650 for TSLA, with a longer-term target ranging from $2,500 to $3,500. However, he notes the inherent risks related to execution, competition, and valuation.

Wall Street’s Mixed Perspective

As the market awaits Tesla’s earnings report, Wall Street carries a mixed sentiment about the stock. Currently, TSLA holds a consensus rating characterized by 15 Buys, 13 Holds, and 10 Sells, translating to a neutral outlook. The average price target sits at approximately $365.82, suggesting potential losses of around 17%.

In conclusion, Tesla’s upcoming earnings report is highly anticipated as investors weigh both the company’s optimistic trajectory and the associated risks. For further investment advice, consider exploring resources like El-Balad for the latest market insights.