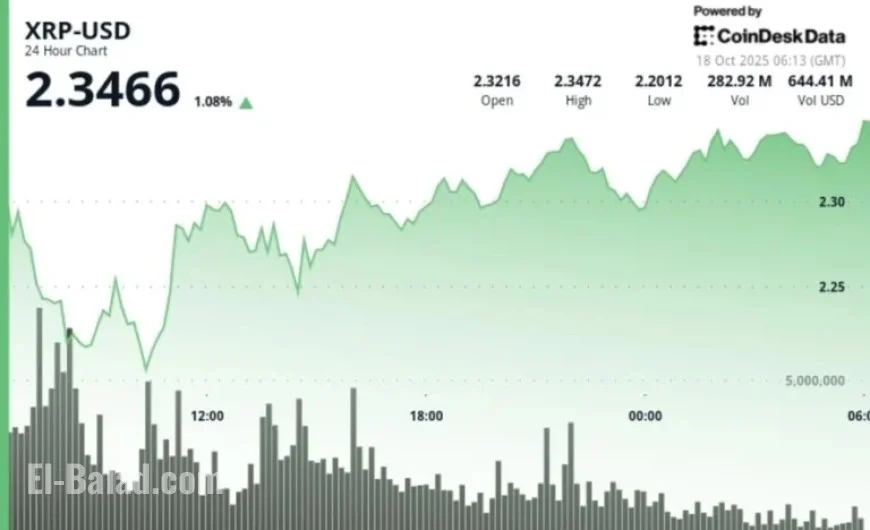

XRP Rebounds After Dip, Traders Anticipate $2.40 Breakout

XRP demonstrated resilience on Friday, recovering from an early dip to $2.19. Significant buyers stepped in to absorb the selling pressure. This rebound occurred amid ongoing concerns regarding U.S.-China trade relations and the upcoming SEC deadlines for spot XRP ETFs.

XRP Price Movements

On October 17, between 06:00 and 05:00 UTC the following day, XRP fluctuated within a 7% range, trading between $2.19 and $2.35. During this period:

- Trading volume peaked at 246.7 million during the 07:00 hour, nearly three times the average for the previous 24 hours.

- After hitting a low of $2.19, the price rebounded to settle at $2.33, marking a 1% increase since the session began.

Market Dynamics

The broader cryptocurrency market experienced a 6% decline, bringing the total market capitalization down to $3.5 trillion. This drop was attributed to macroeconomic tensions and the apprehension surrounding U.S.-China trade negotiations.

The SEC is currently reviewing six pending filings for spot XRP ETFs, a process expected to extend until October 25. Ripple’s initiative to raise $1 billion for its treasury has also contributed to market confidence, with analysts viewing recent price movements as a controlled rotation rather than signs of weakness.

Trading Summary

On the trading day, XRP’s movements included:

- A drop to $2.19 at 07:00 UTC on a volume of 246.7 million, which established a crucial intraday support level.

- A stabilization phase led by bulls, resulting in a climb towards the resistance zone of $2.33 to $2.35.

- In the final trading hour, XRP experienced a slight drop to $2.32, followed by a rebound to $2.33, ultimately gaining 1.8% during that period with a peak tick volume of 1.69 million.

Technical Analysis Overview

The following technical levels were identified:

- Support: The key accumulation zone lies between $2.23 and $2.25, attracting long interest whenever XRP trades below $2.20.

- Resistance: An intraday resistance band between $2.35 and $2.38 limits upward movement; a breakout above $2.40 could signify a shift in momentum.

Late-hour surges in volume and a gradual upward trend following the morning dip suggest a potential reaccumulation phase ahead of possible ETF announcements.

What Traders Are Monitoring

Traders are closely observing several key factors:

- The upcoming SEC approval window for ETFs, from October 18 to 25, and its potential impact on market pricing.

- The ability of XRP to maintain support at $2.30 through the weekend trading sessions.

- The implications of Ripple’s ongoing treasury raise on secondary market dynamics.

- Broader market sentiment as concerns over tariff increases affect altcoin liquidity.

- A possible technical breakout above $2.40, which could signal a rotation back toward the $2.70 to $3.00 range.