General Motors Raises Forecast Amid Better Tariff Outlook; Shares Jump 14%

General Motors (GM) has recently revised its annual profit forecast upward, reflecting a more favorable outlook on tariffs and electric vehicle (EV) production costs. The company’s shares surged by 14% in Tuesday’s early trading, marking one of its largest increases in six years.

Improved Profit Forecast and Shareholder Response

GM’s revised annual adjusted core profit is now expected to fall between $12.0 billion and $13.0 billion. This is a significant improvement from the previous estimate of $10.0 billion to $12.5 billion. The third-quarter results showed quarterly adjusted earnings per share of $2.80, surpassing analysts’ expectations of $2.31.

Reducing Tariff Impact

The company has also updated its projections for tariff impacts, now estimating costs will range between $3.5 billion and $4.5 billion, down from a previous estimate of $4 billion to $5 billion. This change reflects ongoing efforts to mitigate tariff-related expenses.

- Adjusted core profit forecast: $12.0 billion – $13.0 billion

- Previous profit estimate: $10.0 billion – $12.5 billion

- Quarterly adjusted earnings per share: $2.80

- Analysts’ expectations for earnings per share: $2.31

- Updated tariff impact: $3.5 billion – $4.5 billion

Electric Vehicle Challenges

While GM remains committed to its EV strategy, the CEO Mary Barra has acknowledged that near-term EV adoption is expected to be lower than initially planned due to changing federal regulations. GM’s recent shift in EV strategy led to a $1.6 billion financial charge.

Barra emphasized that EVs continue to be the company’s “North Star.” Nonetheless, sales of electric models still represented less than 10% of overall sales in the third quarter, despite strong demand to take advantage of available tax credits.

Ongoing Supply Chain Issues

GM’s revenue for the quarter ending in September slightly decreased to $48.6 billion, reflecting potential setbacks related to supply chain disruptions and increased warranty costs. One area of concern includes production issues linked to the chip supplier Nexperia.

Tariff Relief for the Automotive Sector

Recent tariff updates from the U.S. administration are expected to help U.S. automakers. These updates include an expanded credit for U.S. auto production, allowing manufacturers to receive a credit equivalent to 3.75% of the suggested retail price of U.S.-assembled vehicles through 2030. This initiative aims to offset some import tariffs on parts.

GM’s positive earnings have had a ripple effect on other automotive stocks, boosting shares of rivals such as Ford and Stellantis by 4% and 3%, respectively, in early trading.

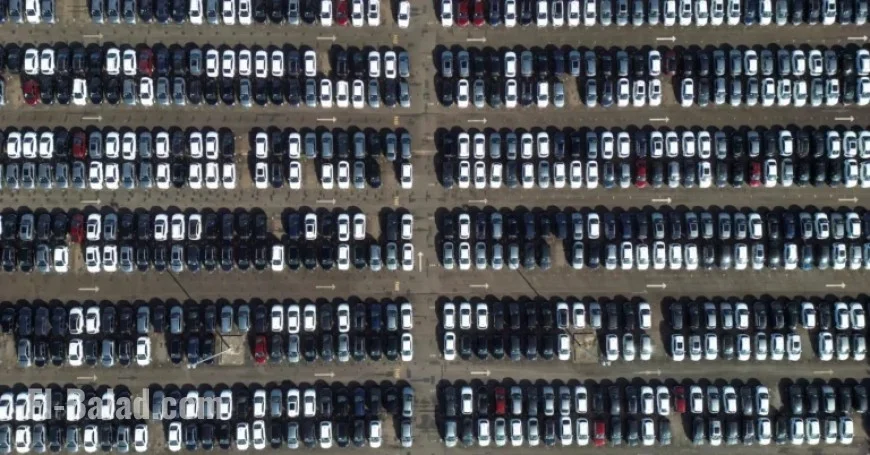

Future Investments and Production Plans

In light of the current economic environment, GM plans to invest strategically across its U.S. facilities. Earlier this year, the company announced a $4 billion investment across operations in Michigan, Kansas, and Tennessee. Meanwhile, Stellantis declared a $13 billion investment plan in the U.S. over the next four years.

As GM continues to navigate the changing landscape of the automotive industry, its focus remains on cost control and aligning production with market demand, particularly in the evolving EV sector.