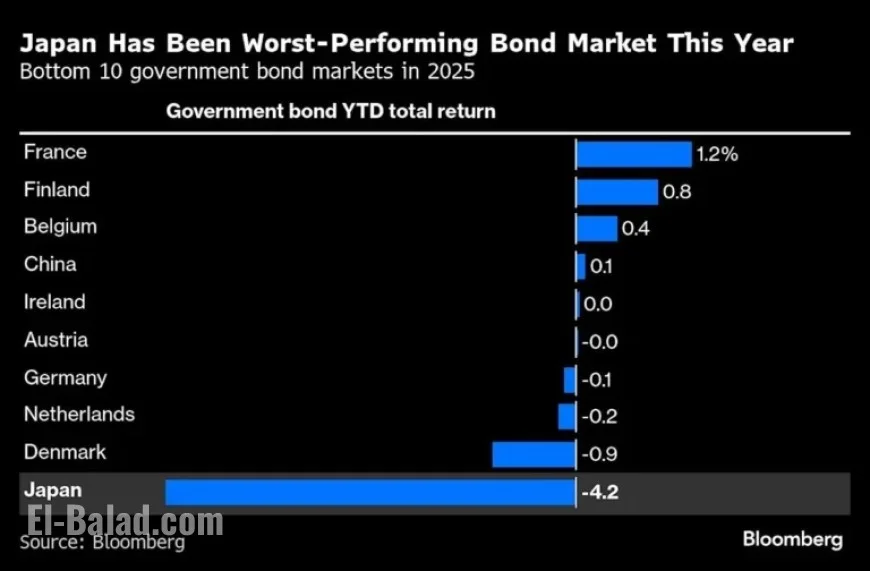

Japan Bonds Plummet, ‘Widow-Maker’ Trade Triumphs Globally

Global bond markets are witnessing a significant upheaval, especially concerning Japanese bonds. Known as the ‘widow-maker’ trade, this strategy involves borrowing and selling Japanese government bonds (JGBs) in anticipation of price declines. This approach has historically led to substantial losses for many investors but currently shows signs of becoming profitable.

Current State of Japanese Bonds

In 2023, Japanese bonds have declined by over 4%, marking them as the poorest performers in global government bond markets. Factors contributing to this decline include fluctuating interest rate expectations and concerns regarding impending fiscal policies under Japan’s new prime minister.

Market Performance

- Japan’s 30-year bond yields reached an all-time high this month.

- The S&P gauge of futures linked to Japanese bonds fell approximately 2% this year.

- Goldman Sachs describes Japan as a “net exporter of bearish shocks” within the global debt market.

Reasons Behind the Trade

Several factors underlie the popularity of the widow-maker trade:

- Core inflation in Japan has consistently exceeded the central bank’s 2% target for nearly three years.

- Despite recent interest rate hikes, rates in Japan remain low compared to global standards.

- Market behavior reflects widespread concerns regarding fiscal policies that impact bond markets from New York to London.

Hiroyuki Kimura of Western Asset Management states that there are persistent short positions in Japanese bonds, particularly in the five-year segment. Mark Dowding from RBC BlueBay Asset Management recently aligned his strategies for a decline in Japan’s 10-year bond prices.

Political Uncertainty and Its Impact

Japan’s bond market is currently facing challenges amid political changes. Sanae Takaichi, who recently secured the position of prime minister, promised spending increases and tax cuts. Her policies could lead to delayed interest rate hikes, raising fears about long-term bond stability.

Market Reactions

- Yields on Japan’s five-year notes slightly fell to 1.22% following news of the central bank’s stance on rate hikes.

- Global investors still see potential in Japan’s bond market due to attractive yields.

However, caution is advised. Analysts note that Takaichi’s ability to implement large-scale stimulus may face restrictions from bond market pressures, reminiscent of challenges former UK Prime Minister Liz Truss faced.

Future Projections

The upcoming months may prove critical for investors in Japanese bonds. With the highest government debt-to-GDP ratio in the developed world, the market remains vulnerable to fluctuations. Projections suggest a continuation of the current trend amid ongoing scrutiny of debt auctions and the weakening yen.

As the new political landscape unfolds, it is essential for traders to monitor the impact of these developments on the widow-maker trade within global bond markets.