U.S. Stocks Drop Amid Trade Concerns and Mixed Earnings Reports

U.S. stock markets faced a decline on October 22, driven by rising trade tensions with China and disappointing earnings reports from major corporations.

Market Overview

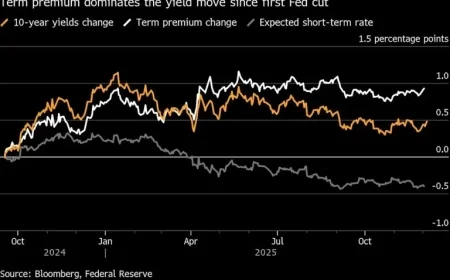

The Dow Jones Industrial Average decreased by 335 points, translating to a drop of 0.71%. Similarly, the S&P 500 index fell by 35 points or 0.53%. The Nasdaq, heavily influenced by technology stocks, dropped 213 points, marking a 1% decline.

Trade Concerns

Investors reacted negatively to news indicating that the U.S. plans to limit exports of American software to China. This measure may affect a wide range of products, including laptops and jet engines.

Corporate Earnings Reports

Disappointing financial results contributed to the market’s downturn. Notably, Texas Instruments’ stock fell 6% after its earnings failed to meet expectations. Netflix experienced an even sharper decline of 10% following a significant earnings miss.

Other notable earnings reports from companies like AT&T showed mixed results, further shaking investor confidence.

Looking Ahead

As the market digests these developments, investors are bracing for upcoming corporate earnings and the September inflation report set to be released on October 24. There are concerns about the reliability of this inflation data, given the ongoing U.S. federal government shutdown.

Analyst Insights on SPDR S&P 500 ETF Trust

The SPDR S&P 500 ETF Trust (SPY) currently holds a Moderate Buy rating based on assessments from 504 Wall Street analysts. This rating consists of 417 Buy recommendations, 80 Hold, and seven Sell suggestions within the last three months.

The average price target for SPY stands at $753.63, indicating a potential upside of 12.35% from current levels.