Intel Stock Soars After Surpassing Third-Quarter Earnings Expectations

Intel Corporation (INTC) achieved significant financial success for the third quarter, outperforming Wall Street expectations. The announcement made late Thursday revealed adjusted earnings of 23 cents per share and sales amounting to $13.65 billion. This exceeded analysts’ predictions of 2 cents per share and sales of $13.17 billion. In contrast, the company experienced a loss of 46 cents per share on sales of $13.28 billion during the same period last year.

Fourth-Quarter Projections

Despite the positive results for Q3, Intel’s guidance for the current quarter fell short of analyst expectations. The chipmaker forecasts adjusted earnings of 8 cents per share on sales of $13.3 billion, while analysts anticipated earnings of 10 cents per share on $13.42 billion in sales.

Stock Performance

In after-hours trading, Intel’s stock surged over 7%, reaching $41.08. Earlier in the day, the stock closed at $38.16, marking a 3.4% increase during regular trading.

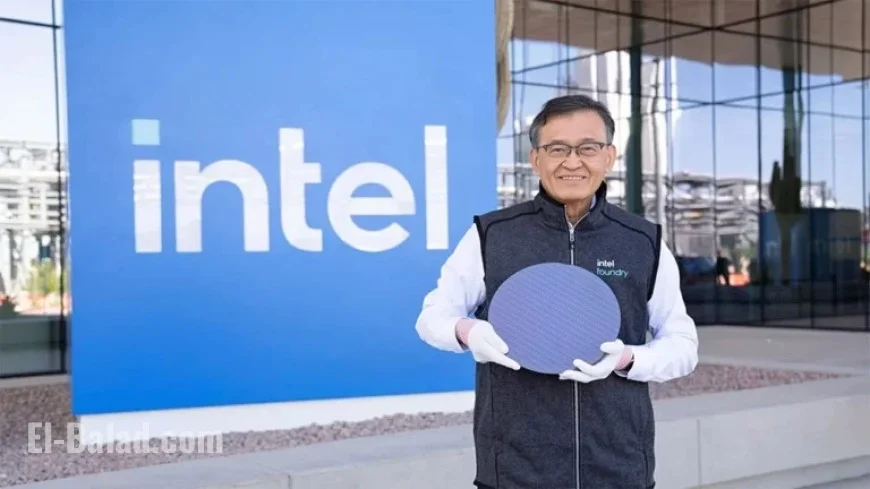

CEO’s Remarks

Chief Executive Officer Lip-Bu Tan highlighted the improved execution within the company. He noted the rising demand for artificial intelligence (AI) is driving growth opportunities across Intel’s product offerings, including core x86 platforms and new ASICs.

Chip Sales Overview

- PC chip sales: $8.5 billion (up 5% year-over-year)

- Data center and AI chip sales: $4.1 billion (down 1% year-over-year)

Strategic Investments

Intel has garnered significant investments recently. On September 18, the company’s stock price jumped after Nvidia announced a $5 billion investment in Intel. Previously, on August 22, it was revealed that the U.S. government would invest $8.9 billion in exchange for a 9.9% equity stake in the firm. Additionally, Japan’s SoftBank Group has committed $2 billion to Intel.

Market Context

The news of Intel’s performance comes amid challenges for other chipmakers. For instance, STMicroelectronics reported lower-than-expected fourth-quarter guidance, leading to a 13.3% decline in its stock. Despite beating Q3 analyst expectations with earnings of 26 cents per share on $3.19 billion in sales, STMicroelectronics has faced eight consecutive quarters of declining earnings and revenue.

Intel’s turnaround trajectory, guided by CEO Lip-Bu Tan since March 18, positions the company to leverage emerging technologies and navigate the competitive landscape of the semiconductor market.