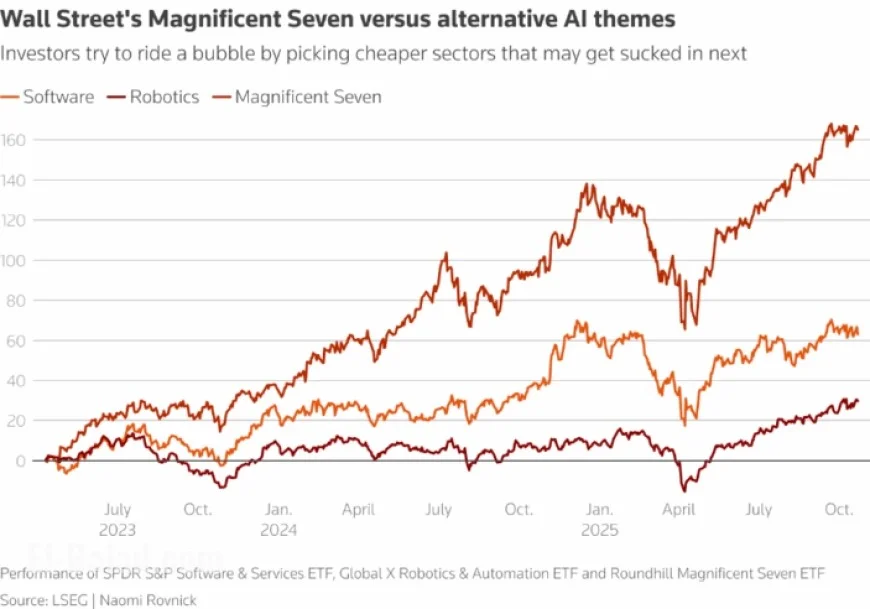

Investors Employ Dotcom Strategies to Mitigate AI Bubble Risks

Investors are cautiously navigating the current landscape of artificial intelligence (AI) stocks, echoing strategies reminiscent of the dot-com bubble era. As AI-driven companies like Nvidia have seen their valuations skyrocket, major investors are searching for ways to capitalize on the market’s growth while mitigating potential risks.

Return to Dotcom Strategies

The recent surge in AI and technology stocks has rekindled interest in strategies that once helped hedge funds during the late 1990s. Francesco Sandrini, Chief Investment Officer at Amundi, noted that some investors are shifting away from high-flying stocks, seeking undervalued opportunities that could yield returns as the market continues its upward trajectory.

Signs of Irrational Exuberance

Sandrini pointed out irrational exuberance in Wall Street’s trading habits, evidenced by the frenzied activity in risky options related to major AI companies. Despite concerning signals, he remains optimistic about the market’s trajectory and is focusing on identifying high-growth opportunities in sectors such as software and robotics.

- Investors are pivoting from Wall Street’s Magnificent Seven stocks, including Nvidia and Microsoft.

- They are looking for emerging sectors likely to benefit from the ongoing AI boom.

AI Boom and Overcapacity Concerns

Some investors express skepticism about the sustainability of the AI boom. Simon Edelsten, Chief Investment Officer at Goshawk Asset Management, warned that excessive spending by various companies might lead to an oversaturated market. Historical trends suggest that timing within any market phase can protect investors from significant downturns.

Insights from History

A study by economists Markus Brunnermeir and Stefan Nagel revealed that hedge funds generally did not short the dot-com bubble but managed to outperform the market by 4.5% per quarter from 1998 to 2000. They achieved this by exiting overvalued stocks before they peaked and investing profits in other opportunities.

- Successful investment strategies during the late 1990s included timely exits from overvalued assets.

- Edelsten sees a dynamic market reminiscent of 1999, suggesting cautious investment in IT consultants and robotics firms.

Diversification Amidst AI Enthusiasm

Amid the booming AI sector, some investors are creatively diversifying their portfolios. Becky Qin of Fidelity International highlighted uranium as a unique opportunity, suggesting that the energy needs of AI data centers could drive demand for nuclear power. Kevin Thozet, from Carmignac, has taken profits from well-performing AI stocks and redirected investments toward suppliers like Taiwan’s Gudeng Precision.

Potential Market Excesses

Concerns over potential overcapacity loom large, similar to the boom experienced in the telecom industry. Arun Sai, a senior multi-asset strategist, noted that all technological advances often come with excesses. He suggested that investments in Chinese tech companies could serve as a hedge against a downturn in U.S. AI stocks.

- Investors are keenly observing the potential for overcapacity in AI data centers.

- Some portfolio managers are hedging against AI downturns by diversifying into healthcare and European assets.

With market dynamics continuously evolving, many investors are reminded of the unpredictability of bubbles. As Oliver Blackbourn of Janus Henderson stated, accurately predicting the end of the AI craze proves challenging, reinforcing the notion that bubbles often reveal their true nature only in hindsight.

In conclusion, the interplay of innovation and caution shapes the current landscape, as investors employ dotcom strategies to navigate AI bubble risks effectively.