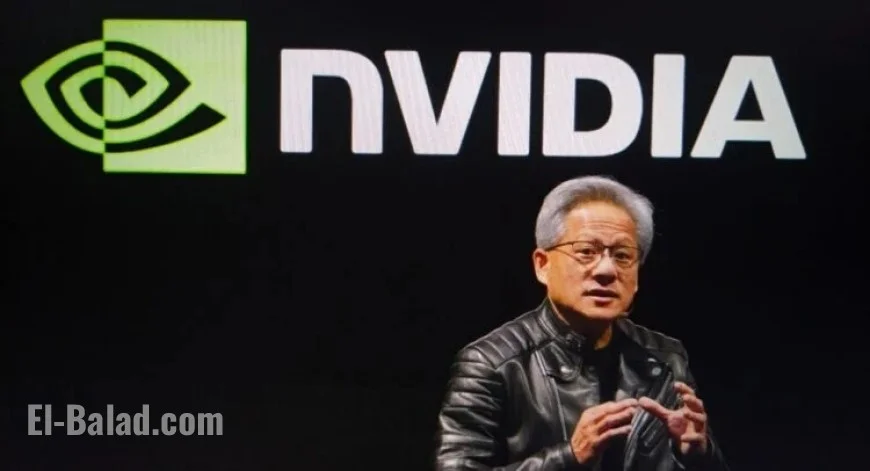

Nvidia stock rockets past $5 trillion: NVDA price surges, AI wins stack up, and Jensen Huang’s net worth leaps

Nvidia stock (NVDA) extended its blistering rally on Wednesday, October 29, 2025, vaulting the company’s market value above $5 trillion intraday as AI infrastructure deals and optimism around next-gen chips drew buyers back in force. By 12:46 p.m. ET (4:46 p.m. UTC), NVDA last traded near $206–$212 after touching an intraday high around $212, with volume running exceptionally heavy—another sign that big money is still leaning into the AI build-out.

NVDA stock price today: what’s driving the move

Investors pointed to three catalysts in the past 24 hours:

-

Fresh AI infrastructure momentum. New data-center networking packages and reference architectures rolling out with top partners gave another nudge to enterprise AI spending plans, reinforcing the view that 2026 capacity is already being “spoken for.”

-

Macro tailwinds. U.S. indexes pushed to record highs ahead of the Fed decision, widening the risk-on window for mega-cap AI leaders.

-

Upbeat sentiment into next results. With consensus expecting steep year-over-year EPS growth in fiscal 2026, traders are positioning for strong guidance on Blackwell-class GPU availability and software attach.

Tape snapshot (midday, Oct. 29):

-

NVDA price: ~$206–$212 intraday range

-

Day change: roughly +3% to +6% at peak

-

Market cap: > $5 trillion intraday

Nvidia AI news: pipelines, partners, and product cadence

Nvidia’s edge remains a flywheel: cutting-edge data-center GPUs (Hopper to Blackwell), high-speed networking, an expanding software stack (CUDA, inference/acceleration frameworks), and tight integration with major OEMs and cloud providers. The newest enterprise bundles emphasize throughput, latency, and power efficiency—a nod to customers building sovereign clouds, private AI clusters, and high-utilization inference farms. With order books stretching well into 2026, even incremental supply signals can swing the stock.

Jensen Huang’s net worth: riding the NVDA wave

As NVDA jumped, Jensen Huang’s net worth climbed sharply in real time, with live tallies placing him in the ~$170–$180+ billion band by midday Wednesday. The step-function increase this week stems from both the market-cap milestone and expectations that Nvidia will preserve its leadership through the Blackwell cycle, sustaining premium margins on silicon and software.

Why the range?

Net-worth trackers update continuously using live share prices and estimated share counts; when NVDA lurches several percent within hours, the models can differ by billions until the close.

What to watch next for Nvidia stock

-

Supply signals for Blackwell. Any color on yields, board availability, and delivery timetables for hyperscalers and sovereign buyers.

-

Networking capacity. High-bandwidth switches and optical links are gating items for AI clusters; expanded output here sustains system-level growth.

-

Enterprise AI demand. Reference designs and turnkey stacks lower adoption hurdles for banks, pharma, government, and telcos—key to broadening revenue beyond hyperscale.

-

Software monetization. Clearer pricing/attach on inference, microservices, and licensed models could lengthen Nvidia’s advantage even if silicon competition intensifies.

Risks that could derail the rally

-

Export and policy constraints. Tighter rules on advanced AI hardware shipments to strategic markets could reshape mix and margin.

-

Competition and substitutions. Custom silicon from cloud providers, rival accelerators, or specialized inference chips could chip away at share in specific workloads.

-

Cycle sensitivity. If AI project slates slip or financing tightens, build-out schedules may get pushed right, hitting near-term growth.

Quick reference: NVDA at a glance (Oct. 29, 2025)

| Metric | Snapshot |

|---|---|

| Intraday price range | ~$206–$212 |

| Day move | +3% to +6% at session peak |

| Market value | > $5T intraday |

| Theme | AI infrastructure super-cycle (GPUs + networking + software) |

| Net worth watch | Jensen Huang ~ $170B–$180B+ (live, price-dependent) |

Nvidia’s run to $5 trillion underscores a simple market message: the AI infrastructure super-cycle remains intact, and NVDA is still the reference trade. Until investors see meaningful cracks in supply, competition, or enterprise adoption, momentum—and Jensen Huang’s rising net worth—has the wind at its back.