Fiserv Revises Guidance and Restructures Leadership Following Earnings Shortfall

Fiserv has faced a significant downturn after missing profit expectations and revising its guidance. The fintech payment company reported earnings that fell short of Wall Street’s projections, resulting in a steep decline in its stock price.

Fiserv’s Earnings Report and Stock Reaction

On Wednesday, Fiserv’s shares plunged to their lowest value in over five years. Following a disappointing earnings report, the company announced a restructuring of its leadership and a revised financial outlook. Shares dropped nearly 41% to $74.14, marking the most substantial one-day decline in the company’s history. Since reaching a high of nearly $238 in early March, Fiserv’s stock has depreciated by nearly 70%.

Financial Forecast Changes

- Full-year revenue growth outlook reduced to 3.5%–4%, down from 10%.

- Expected 2025 profit-per-share revised to $8.50–$8.60, previously projected at $10.15–$10.30.

- Third-quarter earnings reported at $2.04 per share, below the $2.64 analyst target.

- Revenue totaled $4.9 billion, missing forecasts by 8%.

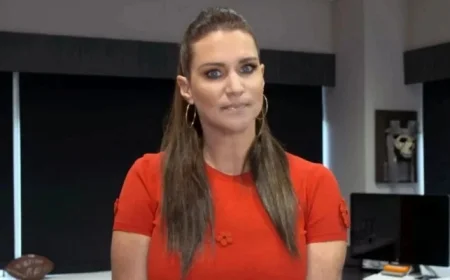

Strategic Leadership Changes

In a move to address these challenges, Fiserv has introduced a five-point action plan, which includes key leadership appointments:

- Paul Todd, former CFO of Global Payments, appointed as Chief Financial Officer.

- Takis Georgakopoulos and Dhivya Suryadevara named co-presidents of the board effective December 1.

- Gordon Nixon, Céline Dufétel, and Gary Shedlin will join the board of directors starting January 1.

CEO Mike Lyons, recently appointed in May, acknowledged the company’s performance issues. He cited factors including slower growth in Argentina and impacts from deferred investments as reasons for the earnings shortfall.

Stock Exchange Move

Furthermore, Fiserv plans to shift its stock listing from the New York Stock Exchange back to the Nasdaq, with trading expected to begin on November 11 under the ticker “FISV.” This move comes after the company only transitioned to the NYSE two years ago. Lyons emphasized the need for resetting growth and margin targets during the conference call with investors.

With these strategic changes and a revised outlook, Fiserv aims to stabilize its operations and restore stakeholder confidence in the coming fiscal periods.