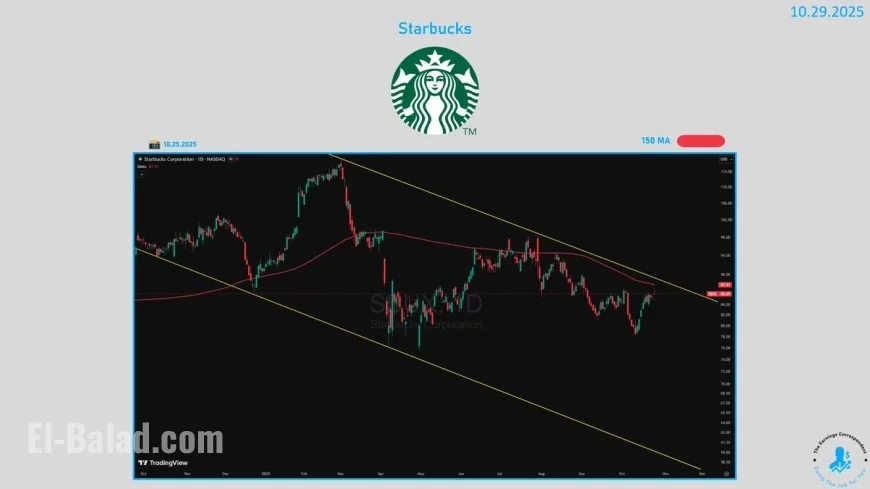

Starbucks stock climbs as first same-store sales gain in seven quarters hints at a turnaround

Starbucks (SBUX) shares advanced after-hours on Wednesday after the company posted fiscal fourth-quarter results that showed global comparable sales ticking back into positive territory for the first time in roughly 18 months. The update, paired with a steady dividend and holiday merchandising already underway, gave investors fresh evidence that management’s reset is taking hold—though questions remain around U.S. traffic, store rationalization, and labor tensions heading into peak season.

SBUX earnings: the headline beats and misses

Starbucks reported quarterly revenue around $9.6 billion, ahead of expectations, with global comp sales up ~1%. Adjusted earnings landed near $0.52 per share, while GAAP EPS—weighed by restructuring charges—was materially lower. Shares rose in late trading as investors focused on the return to comp growth and improving international trends, particularly a rebound in non-U.S. markets.

What stood out

-

First comp gain in seven quarters: A modest rise, but a psychological shift for a brand that’s been working through traffic softness and value perception.

-

International doing the heavy lifting: Outside the U.S., comps improved on better product mix and promotional discipline.

-

U.S. still mixed: Domestic results remain a work in progress as pricing, value messaging, and throughput initiatives ramp.

The board also declared a $0.62 quarterly dividend, underscoring a commitment to shareholder returns amid the turnaround.

Why the stock is reacting

Markets had been braced for another flat to negative comp print. Instead, the company cleared a low bar and demonstrated early traction from menu refreshes, digital offers, and targeted store-level fixes. With sentiment depressed for much of the year, even incremental progress can drive outsized moves in the shares—especially if investors see a credible line of sight to margin rebuilding in 2026.

Key moving parts for the bull case

-

Mix & margin: Premium beverages and seasonal attach rates can widen ticket without over-relying on headline price increases.

-

International runway: Store growth and brand repair abroad offset slower U.S. traffic.

-

Opex relief: Network simplification and selective closures reduce fixed costs; labor and scheduling tools lift throughput at rush.

Store footprint, closures, and the holiday playbook

Management has accelerated a store rationalization that closed hundreds of underperforming locations in the latest quarter while investing in high-throughput formats (drive-thru, pick-up, and café layouts tuned to mobile order density). The goal: concentrate capacity where demand is durable and reduce friction at the make line during peak morning and afternoon dayparts.

For the holidays, Starbucks is leaning into:

-

Seasonal beverage core with limited-time flavors, expanded cold customization, and upsell bundles.

-

Digital offers that target lapsed members and nudge frequency without steep blanket discounts.

-

Operational “sprints”—tight prep windows and staffing templates designed to hold service times when traffic spikes.

Labor overhang: strike votes and negotiations

Union activity is set to intensify into year-end, with strike authorization votes and rallies adding noise just as stores enter their busiest stretch. Investors are watching for:

-

Service continuity: On-time orders and drive-thru times during any job actions.

-

Cost impact: Wage, scheduling, and benefits concessions could pressure near-term margins but may buy stability.

-

Brand risk: Prolonged disputes can dent sentiment among younger, values-oriented customers.

What to watch next for SBUX stock

-

U.S. traffic inflection: A sustained comp recovery needs more than ticket; watch morning transactions and mobile order mix.

-

China cadence: Price, promo, and value positioning must navigate intense local competition while protecting brand equity.

-

Margin bridge: Evidence that store closures, menu engineering, and labor tools expand store-level operating margin through spring.

-

Capital returns: With the dividend intact, any commentary on buybacks in early 2026 would be a positive signal.

Quick scorecard

| Metric (Fiscal Q4) | Result | Investor read |

|---|---|---|

| Revenue | ~$9.6B | Better than expected; mix helped |

| Global comps | +1% | First gain in 7 quarters |

| Adjusted EPS | ~$0.52 | Solid, but below prior-year level |

| GAAP EPS | ~$0.12 | Restructuring drag; one-time noise |

| Dividend | $0.62/share | Income support maintained |

Starbucks stock is getting credit for progress where the market needed to see it: comps, international momentum, and operational discipline. The turnaround isn’t “done”—U.S. traffic, store rationalization, and labor dynamics still pose execution risk—but the tone has shifted from defense to cautious offense. If holiday performance confirms better throughput and healthier tickets without heavy discounting, SBUX enters 2026 with a more convincing path back to durable growth.