AMZN Stock: Amazon Earnings Spark Wild After-Hours Swing as AWS Growth Reaccelerates and Holiday Outlook Lands Strong

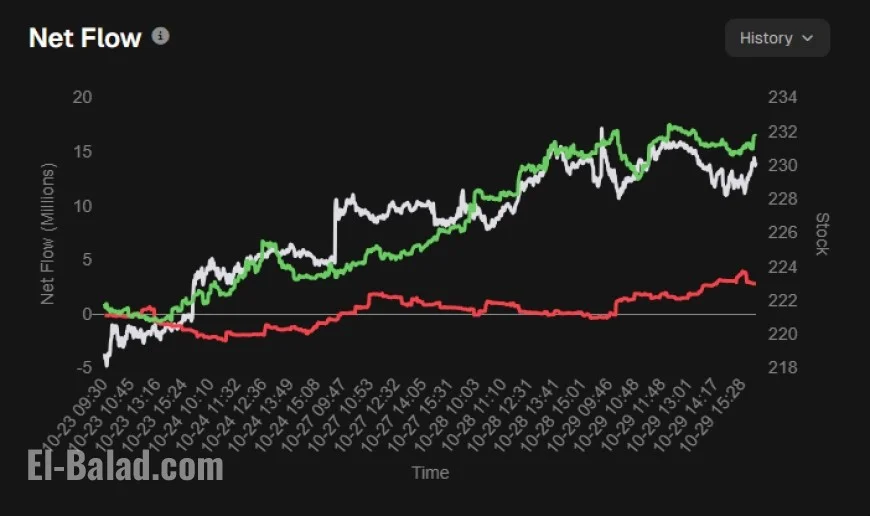

Amazon’s third-quarter scorecard landed after the bell on Thursday, setting off a sharp rally and equally swift reversal as traders parsed cloud growth, profit drivers, and guidance into the peak shopping season. As of 5:17 p.m. ET, the AMZN stock price hovered near $222.86, down roughly 3% from the prior close after spiking as high as $254.59 in early after-hours action. The whipsaw puts AMZN at the center of tonight’s market narrative alongside other mega-caps.

Amazon earnings: headline numbers and what changed

Amazon earnings topped expectations on both revenue and EPS. Net sales rose to about $180.2 billion for Q3, up roughly 13% year over year. Diluted EPS printed around $1.95, aided in part by gains tied to investment holdings. Management also pointed to improving operating efficiency across the North America retail network, a higher-margin advertising mix, and continued discipline in fulfillment costs.

Under the hood, AWS was the swing factor many were watching—and the numbers delivered. Cloud revenue reached roughly $33.0 billion, with year-over-year growth reaccelerating to about 20%, the fastest clip since the 2022 slowdown. That cadence suggests stabilization in optimization headwinds and an early lift from AI-related workloads.

Guidance watch: holiday quarter sets the bar for AMZN stock

For Q4, Amazon earnings guidance called for net sales of approximately $206–$213 billion, implying ~10–13% growth. The range balances strong seasonal demand, ongoing regionalized fulfillment benefits, and typical promotional intensity. The market’s immediate read: solid top-line ambition with enough wiggle room for macro and competitive variables.

Key watch items into Q4:

-

Unit growth vs. margins: Promotion-heavy weeks can boost volume but pressure gross margin; regionalized shipping aims to cushion that impact.

-

Ads & marketplace mix: Third-party seller growth and advertising momentum generally support operating income resilience.

-

AI and data center capex: The pace of AI adoption and infrastructure spend will shape 2026 margin narratives.

AMZN stock price: why the post-print reversal?

The initial jump reflected relief on Amazon earnings and AWS. The fade likely combined profit-taking after a strong YTD run, algorithmic volatility around guidance language, and traders re-squaring positions ahead of Friday’s flows. With the AMZN stock price traversing a wide band ($222–$255) within minutes, liquidity pockets exaggerated moves—common for mega-caps on earnings day.

Levels traders are watching:

-

$250–$255: Post-print spike zone; a sustained break would re-ignite momentum.

-

$222–$225: After-hours support; holding here frames the move as digestion.

-

~$215: Recent consolidation shelf; a loss could invite a deeper back-test.

Amazon earnings call: themes to listen for

The Amazon earnings call typically drills into AWS demand signals and retail efficiency. Expect focus on:

-

AWS pipeline quality: From optimization to expansion—timelines for AI workloads moving from pilots to production.

-

Regionalized fulfillment: Quantifying delivery-speed gains and cost per shipment trends.

-

Advertising flywheel: Measurement enhancements and incrementality for sellers and brands.

-

Capital allocation: Data center capacity, Trainium/Inferentia rollouts, and potential tailwinds to free cash flow.

Quick tape check: AMZN and AAPL after hours

-

AMZN stock price: $222.86 at 5:17 p.m. ET (range $222.71–$254.59 after hours).

-

AAPL stock price: Around $271.40 at 5:16 p.m. ET, modestly higher ahead of its own update window.

Times are approximate; after-hours trading remains volatile and can shift quickly.

What this Amazon earnings report means for investors

For long-term holders, Q3 reinforces three structural drivers:

-

Cloud resilience with a credible path to reacceleration as AI consumption builds.

-

Retail leverage from regionalized logistics and automation.

-

High-margin adjacencies like advertising helping smooth retail seasonality.

For short-term traders, the setup is binary around the $222–$225 support and $250–$255 resistance. Follow-through will hinge on call commentary about AWS backlog, Q4 promotional posture, and any fresh color on 2026 capex and AI monetization arcs.

The headline beat, a sturdier AWS, and a constructive holiday range are positives for AMZN. The price action—big pop, sharp fade—signals a market demanding proof that cloud reacceleration and retail efficiency can compound through year-end and into 2026. Keep an eye on management’s Q4 execution checkpoints and any updates on AI workload traction; those will likely dictate the next decisive move in the AMZN stock trend.