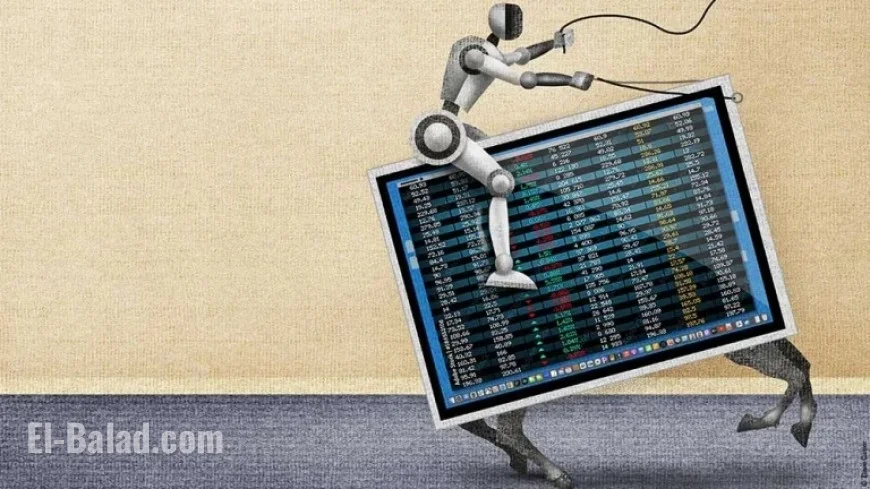

AI Stocks Surge as Capital Expenditure Booms Indefinitely

The artificial intelligence (AI) sector continues to gain momentum, as recent earnings reports from major tech companies indicate robust investment and growth in capital expenditures related to AI. Industry giants Meta Platforms, Microsoft, Google parent Alphabet, Amazon, and Apple are all committing increasing resources to AI initiatives, solidifying the trend amidst discussions of a potential AI bubble.

Strong Earnings Signal Continued Investment in AI

Meta, Microsoft, Google, Amazon, and Apple reported impressive results for the third quarter, highlighting their plans to increase investment in AI infrastructure. Despite Meta’s earnings missing expectations due to a significant tax charge, the company announced plans for “notably larger” capital expenditures in 2026.

Key Financial Results

- Meta Platforms: Reported capital expenditures of $19.4 billion, twice the spending from the previous year.

- Microsoft: Achieved capital expenditures of $35 billion, a 74% increase year-over-year.

- Google: Indicated capital expenditures of $24 billion, up 83% from 2022.

- Amazon: Reported $34.2 billion in capital expenditures, aiming for a total of $125 billion by year-end.

- Apple: Anticipated further investments in AI, raising operating expenses in the coming quarter.

Exploring the AI Capital Expenditure Boom

As companies strive to enhance their AI capabilities, the demand for data center infrastructure continues to grow. An April 2025 report from McKinsey & Company projected that AI data centers would require approximately $5.2 trillion in capital expenditures, which reflects the trend among major tech firms.

Projected Capital Expenditure Growth

| Company | FY 2024 (in billion $) | FY 2025 (Projected, in billion $) | Growth Rate |

|---|---|---|---|

| Amazon | 83 | 119 | 43% |

| 53 | 87 | 64% | |

| Meta | 37 | 71 | 92% |

| Microsoft | 45 | 65 | 44% |

| Apple | 9.5 | 13 | 37% |

Market Implications of AI Spending

Investment in AI plays a crucial role in the economy, particularly as companies like Meta, Microsoft, Google, and Amazon cumulatively represent over $11.5 trillion in market capitalization. These firms collectively drive more than 40% of the S&P 500’s total market cap.

Driving forward, Microsoft’s CEO Satya Nadella emphasized the importance of building infrastructure capable of maximizing efficiency in AI workloads. This extensive focus on advanced technology solutions is poised to influence various sectors, including construction and energy, crucially impacting the economy and job market.

Concerns Among Analysts

While optimism surrounds the AI investment boom, some analysts express caution. The rapid increase in capital expenditures raises concerns regarding the sustainability of returns on these investments. Notably, Meta’s recent stock decline highlights Wall Street’s apprehension about escalating spending commitments.

Future Outlook for AI Stocks

The discussions surrounding an AI bubble persist, yet many analysts believe the current investment surge reflects the dawn of a fourth Industrial Revolution. As companies continue to dedicate resources towards AI and associated technologies, their impact on the market and overall economy remains significant.

With continued growth expected, stakeholders are closely monitoring these developments as AI strategies shape the future of technology.