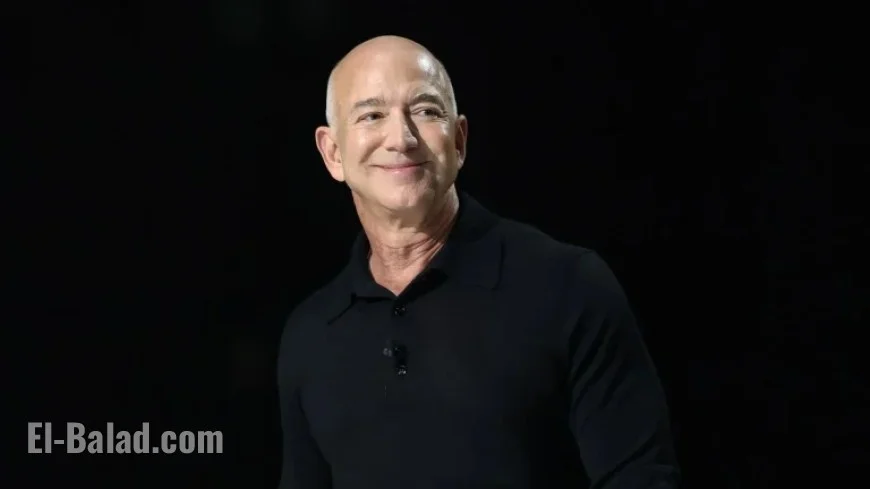

Amazon’s Surge Adds $24 Billion to Jeff Bezos’ Wealth

Jeff Bezos experienced a significant boost in his net worth, totaling approximately $24 billion, following a remarkable surge in Amazon’s stock price on Friday. The increase was driven by a strong earnings report that exceeded Wall Street forecasts, highlighting robust demand for the company’s artificial intelligence services.

Amazon’s Impressive Stock Surge

On Friday, Amazon shares rose 11.5%, reaching about $248.60 shortly after trading began. This followed a 3.2% decline the previous day before the earnings report was released. This notable rise marks one of the largest single-day increases for Amazon since April, when stock jumped nearly 12%. A continuation of this upward momentum could approach Amazon’s impressive 12.1% gain recorded in November 2022.

Strong Earnings and Revenue Figures

Amazon’s earnings report revealed revenues of $180.2 billion and earnings per share of $1.95, surpassing analysts’ expectations of $177.9 billion and $1.57, as reported by FactSet. Key to this growth was a 20% annual increase in sales from Amazon Web Services (AWS), which generated $33 billion. CEO Andy Jassy noted that the strong demand for Amazon’s AI offerings significantly contributed to these results, including a recent $11 billion AI data center launched for Anthropic’s AI models.

Impact on Jeff Bezos’ Wealth

As a result of the rising stock prices, Jeff Bezos’ net worth climbed to approximately $259.4 billion, making him the world’s third-richest person. This marks a 10.2% increase in his wealth due to the 8% equity he holds in Amazon. Interestingly, Bezos had previously witnessed a $6.6 billion decline in net worth on Thursday due to falling share prices.

Stock Performance Overview

- Amazon shares have increased by 53% since hitting a low of $161.38 in April.

- In February, the stock set a new record by exceeding $240.

- Overall, Amazon shares have risen more than 12% this year.

Market Conditions and Strategic Shifts

Amazon, similar to many leading companies, is pivoting its strategy to focus more on AI products and cloud infrastructure. The growing demand has been complemented by competitive pressures from Nvidia, Google, and Microsoft. Recently, Amazon announced a plan to lay off 14,000 corporate employees, aiming to streamline its operations. Jassy emphasized that these layoffs are not currently driven by financial or AI-related motives.

Analyst Insights

Experts commend Amazon’s growth trajectory despite previous concerns regarding potential impacts from former President Donald Trump’s tariff policies. Analysts from Pivotal Research noted Amazon’s strong market position, attributing its resilience to its unmatched scale and various organic growth opportunities, particularly in its high-margin cloud services.