SM Energy and Civitas Resources Merge in $12.8 Billion Deal Boosting Stockholder Value

SM Energy Company and Civitas Resources, Inc. have announced a significant merger that will enhance shareholder value. The deal, valued at approximately $12.8 billion, is an all-stock transaction aimed at creating one of the leading independent oil and gas companies in the U.S.

Transaction Overview

Under this merger agreement, Civitas shareholders will receive 1.45 shares of SM Energy common stock for each share they own. This exchange ratio reflects the companies’ respective closing share prices as of October 31, 2025. Upon completion, Civitas shareholders will own about 52% of the combined entity, while SM Energy shareholders will possess approximately 48%.

Enhanced Asset Portfolio

The merged company will hold a robust portfolio of approximately 823,000 net acres, primarily concentrated in high-return shale basins like the Permian. This consolidation is expected to significantly boost free cash flow, projected to be over $1.4 billion annually by 2025.

Strategic Goals and Synergies

- Targeted annual synergies of around $200 million, with potential upside to $300 million.

- Focus on reducing debt and maintaining a fixed quarterly dividend of $0.20 per share.

- Strengthened operational and financial metrics post-merger, enhancing overall stockholder value.

Leadership and Governance

The combined company will feature a board of 11 directors, including 6 from SM Energy and 5 from Civitas, with Julio Quintana serving as the Non-Executive Chairman. Herb Vogel will lead as CEO, with a planned transition to Beth McDonald.

Future Outlook

This merger marks a pivotal moment in the energy sector, positioning the new entity as a top producer in the U.S. oil market. The transaction is anticipated to close in the first quarter of 2026, following regulatory approvals and shareholder votes from both companies.

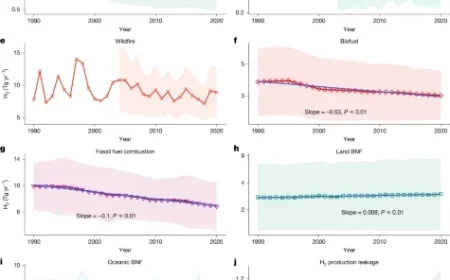

Commitment to Sustainability

Both companies are dedicated to maintaining high standards of environmental stewardship and operational excellence. They intend to uphold sustainability initiatives while expanding their positive influence in the communities they serve.

Investor Communication

A joint conference call will be held today at 8:00 a.m. Mountain time to discuss the merger details and answer any investor queries. Additional materials regarding the transaction will be available on the respective company websites.