Warner Bros. Sale Sparks Fear in Theater Industry

Concerns are mounting in the theater industry as speculation grows surrounding the potential acquisition of Warner Bros. by major Hollywood players such as Paramount or Netflix. Executives warn that this move could drastically impact the number of films available for theatrical release, triggering fears of further consolidation within a struggling market.

Implications of Warner Bros. Sale

The discussions surrounding Warner Bros. have intensified recently. With the studio achieving over $4 billion in worldwide gross this year, its potential acquisition has raised alarms. Independent theater owners fear that a merger could lead to a significant reduction in film output. One anonymous theater owner described the situation as a “red alert,” highlighting the necessity for industry-wide acknowledgment of the antitrust implications.

Historical Context

Similar scenarios have unfolded in the past. Following Disney’s acquisition of 20th Century Fox in 2019, the number of films released by the studio plummeted, transitioning from a robust output to a streamlined selection focused on their streaming service. This trend has left theater owners wary of future mergers.

Theater Industry Response

- Theater executives urge immediate action against the proposed Warner Bros. merger.

- Organizations like Cinema United are mobilizing to assess and coordinate their response.

- Concerns are particularly directed toward Netflix’s approach to utilizing Warner’s intellectual properties, primarily through its streaming platform.

Market Dynamics

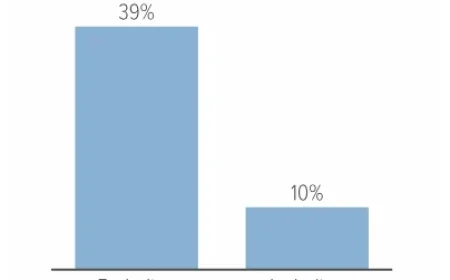

This year, Warner Bros. has achieved impressive box office success, earning $1.85 billion from 11 releases. The studio’s ability to sustain such momentum under the potential constraints of a new parent company remains questionable. Reports suggest that combining Warner with Paramount could push their combined market share above 30%, triggering serious antitrust concerns.

Currently, Warner Bros. holds a 26.9% market share, with Paramount at 6.3%, leading to fears about competition and production. Previous mergers have shown that consolidation often results in fewer films hitting theaters, creating disillusionment among exhibitors.

Future Outlook

While some industry insiders maintain cautious optimism about the potential benefits of a merger with Paramount, skepticism prevails. Executives express concerns that any deal with Netflix would favor streaming over theatrical releases, undermining the theatrical model. This sentiment is underscored by Netflix’s commitment to releasing most films exclusively on its platform.

Call to Action

As the prospect of a Warner Bros. sale looms, industry stakeholders are encouraged to organize and advocate for their interests. Advocacy could focus on urging state attorneysgeneral to file antitrust lawsuits. Such actions may be critical in protecting the long-term viability of the theatrical sector amidst shifting market dynamics.

In conclusion, the potential sale of Warner Bros. has raised significant concerns within the theater industry. Executives warn that the long-term consequences could severely impact cinema offerings, making it imperative for stakeholders to respond proactively.