Opinion: Prediction Markets Revolutionize 21st Century Futures Trading

The emergence of prediction markets is transforming the landscape of futures trading in the 21st century. These platforms operate under the regulation of the Commodity Futures Trading Commission (CFTC), similar to traditional futures markets. Despite their federal oversight, some state regulators are attempting to challenge this regulatory framework.

Regulatory Challenges Facing Prediction Markets

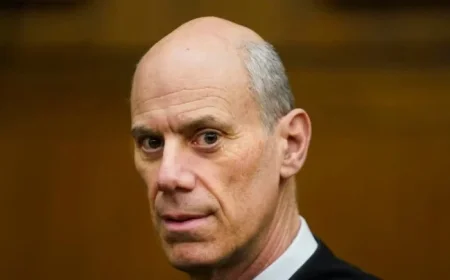

Recently, concerns have grown regarding the status of prediction markets. Former CFTC Commissioner Kristin Johnson voiced her skepticism about the perception of these markets. This skepticism echoes historical doubts similar to those faced by futures markets in the late 19th and early 20th centuries.

Historical Context of Futures Trading

- Futures markets emerged during the late 1800s and early 1900s.

- Initially, critics viewed them as speculative gambling.

- Congress stepped in to regulate these markets, affirming their value.

This regulatory approach has led to the development of one of the most stable financial systems globally. It was founded on the principle that well-regulated markets assist individuals and businesses in managing uncertainty. Prediction markets, inherently similar, warrant the same consideration and support.

The Potential Impact of Legal Decisions

Current legal disputes, such as those involving Kalshi, pose a significant risk. A ruling against prediction markets could set a dangerous precedent. This outcome might empower state regulators to exert gambling authority over federally regulated futures markets.

Potential Consequences

- State control could undermine the integrity of agricultural futures.

- Farmers and businesses could face legal confusion in navigating these markets.

- The future of financial tools crucial to American agriculture could be jeopardized.

Understanding the implications of these developments is essential. This situation transcends the interests of a single company; it concerns the fundamental integrity of a system relied upon by families, farmers, and businesses across the country. Dismantling the authority of the CFTC risks causing chaos in financial navigation, particularly within the agricultural sector.

A Call for Unified Support

The ongoing discussions surrounding the regulation of prediction markets should not become partisan. Upholding the authority of the CFTC is a matter of fundamental common sense. As the nation assesses the future of these markets, it is crucial to recognize their potential to enhance American financial stability.