Polymarket Faces Pressure Following Latest European Ban

Polymarket, a prediction market platform, is facing increasing global scrutiny as it navigates complex gambling regulations. Recently, Romania added the company to its blacklist, citing its unlicensed operations and involvement in over $600 million in transactions during the country’s elections in May.

Romania’s Ban on Polymarket

The National Office for Gambling (ONJN) in Romania issued a statement on LinkedIn, categorizing Polymarket as a gambling platform. The ONJN asserts that Polymarket operates outside legal boundaries, stating that it does not possess the required license to function in Romania.

Key Insights from Romania’s Ruling

- Polymarket’s business model qualified as “counterparty betting,” which necessitates proper licensing.

- The ONJN emphasized the legal implications of redefining betting as trading, warning against creating a loophole for unregulated activities.

- President Vlad-Cristian Soare clarified that any betting on future outcomes, whether in fiat or cryptocurrency, falls under gambling laws requiring oversight.

Global Implications and Market Response

Polymarket’s ban marks yet another setback as several countries, including France, Australia, and Switzerland, have restricted access to the platform. Other nations such as Poland, Singapore, Thailand, and Belgium may also introduce similar measures by the beginning of 2025.

The increasing resistance towards prediction markets raises a fundamental question in the U.S.: Are prediction markets synonymous with gambling? This debate highlights ongoing legal battles and differing state regulations regarding financial trades that involve event contracts.

Kalshi’s Positioning in the U.S. Market

Kalshi, a competing prediction market founded in 2018, is actively engaged in legal disputes related to its sports event contracts. The company has garnered wide-reaching support and operates in 140 countries after securing $300 million in funding.

Factors Influencing the U.S. Market

- Kalshi remains operational amid lawsuits from several state regulators.

- The Nevada Gaming Control Board was the first to issue a cease-and-desist letter to Kalshi.

- Support from major organizations like the NHL indicates growing acceptance of prediction markets.

Polymarket’s Future Prospects

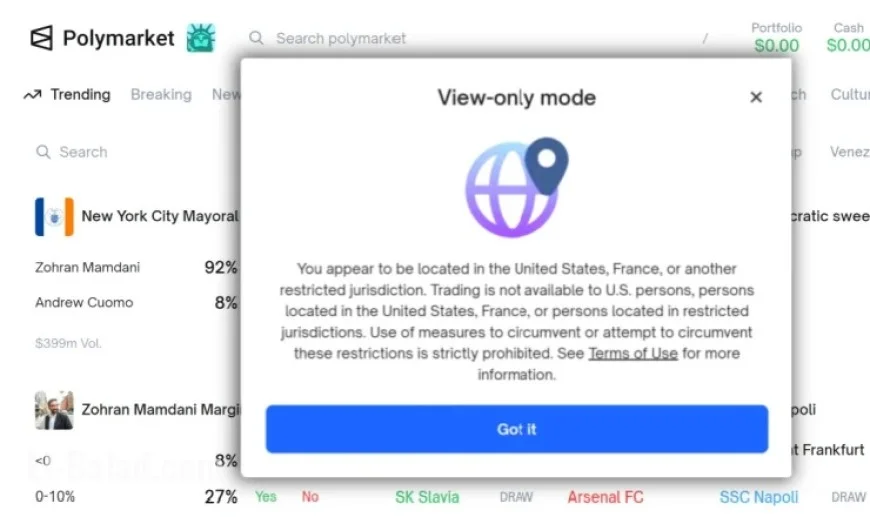

Polymarket, banned from the U.S. market in 2022, is strategizing a return after reaching an agreement with the Commodity Futures Trading Commission (CFTC). The firm recently acquired QCEX for $112 million, giving it a potential path to re-enter the U.S. market.

The Intercontinental Exchange, the owner of the New York Stock Exchange, has committed to invest up to $2 billion, elevating Polymarket’s valuation to approximately $8 billion. This financial support could be crucial as Polymarket attempts to navigate a challenging global landscape.

Conclusion

Polymarket continues to feel the pressure of the latest European ban, particularly from Romania. The company must contend with both local and international regulatory hurdles as it seeks to redefine its role in the financial markets.