Bitcoin Plummets Below $100,000, Sparking Intense Fear Among Traders

Bitcoin has dropped below the $100,000 mark twice in a single day, triggering significant concern among traders. This decline marks the first time since June that the cryptocurrency has fallen below this critical threshold. Nic Puckrin, cofounder of Coin Bureau, noted that the situation has left investors feeling an “almost biblical level of dread.”

Market Impact and Statistics

Recent data shows that total liquidations in the cryptocurrency market reached $1.6 billion in just 24 hours, according to CoinGlass. Additionally, CoinMarketCap’s Fear and Greed Index has sunk to 20, indicating a state of “extreme fear,” the lowest level observed since April. With such shifts in sentiment, traders are left wondering about Bitcoin’s next moves.

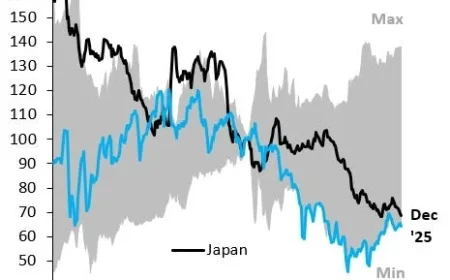

Recent Price Trends

Although Bitcoin showed signs of recovery on Wednesday, the price remains significantly below its October 6 all-time high. In just the early part of the week, Bitcoin ETFs experienced outflows exceeding $763 million, as reported by SoSoValue.

Factors Influencing the Decline

- Citi analysts attribute the drop to several factors, including ETF appetite and impaired flows.

- Technical indicators, such as Bitcoin trading below its 200-day moving average, are also concerning.

- CryptoQuant analysts pointed out that Bitcoin has breached key support levels, notably the 365-day moving average of $102,000.

This breach has historically indicated shifts in market phases, with a failure to regain this level possibly leading to a more significant downturn.

Risks Ahead

Additional risks that could exacerbate market conditions include macroeconomic factors and a prolonged shutdown. Concerns surrounding digital asset treasuries continue to dampen traders’ risk appetite, which may further influence Bitcoin’s trajectory.

Experts Weigh In

Timothy Misir from Blockhead Research Network warns that losing the $98,000 support level could signal a structural shift towards a bearish phase. If the price drops below $95,000, it may incite panic among investors. Despite these cautionary signals, some analysts maintain a positive outlook for Bitcoin. While November appears to be a volatile month, they believe the bull market could persist.

Puckrin stated, “This sell-off is nerve-wracking, but I still see $150,000 as a likely top for this cycle.” He emphasized that while the ride may be bumpy, the long-term fundamentals remain intact, highlighting expected liquidity and potential rate cuts as supportive factors.