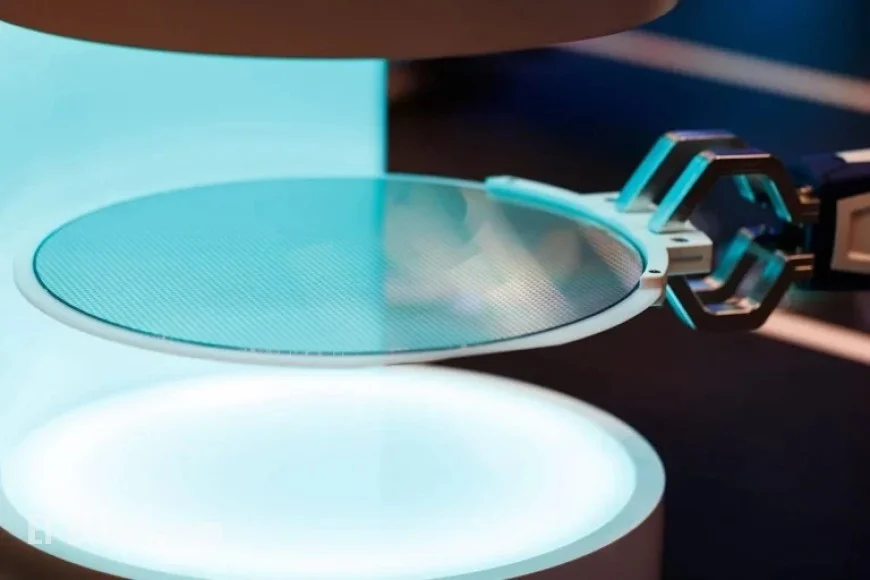

Valuation Concerns Halt Global Chip Stock Rally

This year, the global semiconductor stock rally faced significant obstacles as concerns about valuations intensified. Investors are increasingly wary that the gains achieved by leading chipmakers may be excessive. Recent trading sessions saw Advanced Micro Devices Inc. (AMD) shares drop over 4%, following disappointing guidance that failed to meet high investor expectations.

Market Setbacks Influence Stock Performance

Tuesday marked the Philadelphia Semiconductor Index’s largest decline in three weeks, falling by 4.1%. This downward trend extended across international markets.

- In Asia, Taiwan Semiconductor Manufacturing Co. experienced a 3% decrease.

- South Korea’s Kospi Index was impacted, with Samsung Electronics Co. dragging it down by 2.9%.

- European markets also felt the pinch, with ASML Holding NV and ASM International NV both dropping by 2%.

Investor Sentiment and Economic Concerns

Market participants are expressing growing anxiety regarding the high valuations in the semiconductor sector. Despite a surge in investments from major tech firms in artificial intelligence infrastructure, the pullback highlights a potential reevaluation of stock prices. Morgan Stanley strategist Marina Zavolok remarked on Bloomberg TV that while upside potential remains, concerns about current valuations persist.

The atmosphere on Wall Street has been similarly strained, with warnings of a potential correction emerging from leading executives. This has coincided with tempered expectations for Federal Reserve rate cuts and the possibility of an extended government shutdown in the U.S. Hedge fund manager Michael Burry has also weighed in, revealing short positions on companies like Palantir Technologies Inc. and Nvidia Corp.

Valuation Concerns Take Center Stage

As uncertainty continues, analysts are scrutinizing the current price-to-earnings ratios of semiconductor stocks. The Philadelphia Semiconductor Index, for instance, is valued at 28 times next year’s earnings—significantly higher than its 10-year average of 19 times. Questions linger about whether substantial tech companies, including Amazon.com Inc. and Meta Platforms Inc., will sustain their spending in computing capacity despite lukewarm returns.

Some market observers view the recent pullback as necessary, allowing the sector to cool off from its previously rapid ascent. Vikas Pershad, an Asian equities portfolio manager at M&G Investments, noted the intensity with which he monitored declines on U.S. markets until early morning, suggesting that investors should remain vigilant for potential buying opportunities as prices stabilize.

Outlook Ahead

As the semiconductor market recalibrates, the prevailing narrative centers on balancing enthusiasm for AI technologies with prudent investment strategies. Analyst sentiments indicate that while the volume of capital flowing into the sector remains strong, caution is warranted when considering future investments.