Fed Researchers: Tariffs Cut Inflation, Impact Jobs and Economic Activity

A recent study spanning over 150 years has revealed significant insights into the relationship between tariffs and economic conditions. Conducted by San Francisco Federal Reserve researchers Régis Barnichon and Aayush Singh, the study challenges traditional views on tariffs and inflation. It suggests that higher tariffs can initially lead to reduced inflation while negatively impacting job markets and economic activity.

Tariffs and Their Impact on Inflation

The research indicates that increased tariffs can create economic disruption, ultimately contributing to lower inflation rates. Barnichon and Singh assert that this phenomenon contradicts standard economic models, which typically predict that tariffs should raise consumer price index (CPI) inflation.

Short-Term Economic Effects

The authors found that higher tariffs manifest as aggregate demand shocks. This type of shock results in both inflation and unemployment moving in the same direction—downward in this case. Key findings include:

- Tariffs lead to reduced economic activity.

- They increase unemployment rates.

- They contribute to lower inflation in the short run.

Potential Explanations for Lower Inflation

Several mechanisms could explain the study’s findings. The uncertainty surrounding tariffs can dampen consumer and investor confidence. This diminished confidence leads to decreased economic activity, exerting downward pressure on inflation. Additionally, tariffs may trigger a decrease in asset prices, further reducing demand and causing higher unemployment.

Before World War II, a 4-percentage-point increase in tariff rates led to a 2-percentage-point reduction in inflation and a 1-percentage-point rise in unemployment. Although findings post-war are less certain, they still indicate a trend of inflation reduction with increased tariffs.

Current Context and Political Reactions

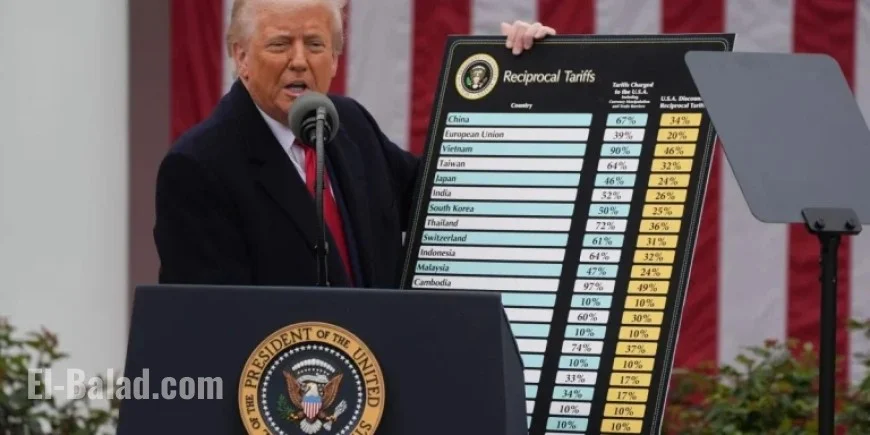

The implications of these findings are particularly relevant today. Despite the ongoing trade tensions initiated by former President Trump, his administration has argued that tariffs would not exacerbate inflation. However, recent voter dissatisfaction over rising costs has led to Trump’s decision to eliminate tariffs on certain commodities like beef and coffee.

Economic Indicators Amid Tariff Policies

While the economy exhibited resilience despite tariff-related concerns, the recent government shutdown has affected key economic indicators. Despite a significant rebound in GDP and continued consumer spending, employment gains have slowed. In September, payroll growth plummeted to just 22,000 jobs.

Some experts suggest that even if inflation decreases, voters expect more affordable living conditions. The dissatisfaction is palpable, with many blaming government policies for eroding affordability. Paul Donovan, chief economist at UBS Global Wealth Management, emphasized the public’s frustration with the current economic climate and their desire for genuine improvements in affordability.

Conclusion

As the economy grapples with the implications of tariffs, understanding their nuanced effects on inflation, jobs, and consumer confidence is crucial. The findings from the Federal Reserve study open up new discussions about traditional economic theories and the ongoing dialogue surrounding tariffs and their impact on everyday life.