Powerball Jackpot Soars to $570 Million: Post-Tax Winning Amount Revealed

The Powerball jackpot has surged to an impressive $570 million due to no winning tickets being sold during the latest draw. The increase follows a significant win in the Mega Millions lottery, where a ticket in Georgia won a staggering $980 million.

Key Details of the Powerball Jackpot

No tickets matched all six winning numbers drawn, which were 6, 7, 12, 47, 53, and the Powerball number 21. As a result, the jackpot has risen in anticipation of the next drawing on Monday night.

Winnings and Taxes Explained

If someone matches all the numbers, they face a choice for their winnings:

- Annuity Option: Receive $570 million paid over 30 years.

- Lump Sum Option: Collect $266.9 million immediately.

However, opting for the lump sum comes with substantial tax implications. A federal withholding tax of 24% is applied right away, reducing the payout to $202.8 million. With the highest federal marginal tax rate at 37%, the net winnings can decrease to approximately $168.1 million after all taxes.

Yearly Payments for Annuity Option

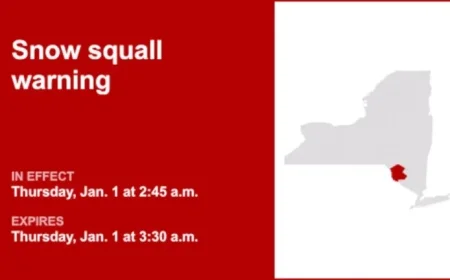

Choosing the annuity gives the winner yearly payments averaging $12 million after federal taxes. It’s essential to consider state taxes as well, which vary significantly. Some states, like California, Texas, and Nevada, do not impose state income tax on lottery winnings. In contrast, New York levies a tax rate as high as 10.9%.

Upcoming Powerball Draw

The next Powerball drawing is set for Monday at 10:59 p.m. EST. You can watch it live on the Powerball website. Should no tickets match all six numbers again, the subsequent drawing will take place on Wednesday.