BTC Market Turmoil Unveils New Crypto Dynamics

The latest movements in the cryptocurrency market reveal significant shifts in how digital assets are being valued. Bitcoin recently experienced a notable decline, slipping below $90,000. However, the reaction across the crypto landscape has deviated from typical patterns associated with such dips.

Shifting Crypto Dynamics Amid BTC Market Turmoil

According to insights from Enflux, a market maker based in Singapore, the recent price movements depict a transformation from a liquidity-driven market to one that is fundamentally driven. During this period, major cryptocurrencies, particularly those lacking clear revenue or institutional relevance, have suffered declines ranging from 60 to 80 percent.

Market Analysis: Current Trends

- Bitcoin: Currently trading around $92,234 after recovering from an earlier drop.

- Ethereum: Holding steady near $3,099, reflecting stability in the broader market.

- Gold: Prices have dropped for four consecutive days, currently at $4,064.60 per ounce.

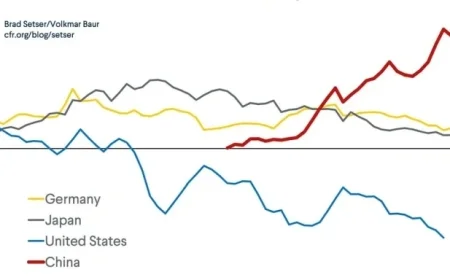

This evolving landscape suggests a more ordered market structure. Enflux noted that traditional altcoin seasons, characterized by dramatic price shifts due to excess liquidity and retail enthusiasm, are not as pronounced in this market cycle. Instead, assets tied to staking, ETFs, or other practical applications are showing resilience.

Expert Perspectives on Market Dynamics

March Zheng from Bizantine Capital shared similar observations regarding the relative ranking of the top twenty cryptocurrencies. He noted that during significant corrections in Bitcoin’s price, altcoins typically experience larger declines; however, the current market shows a balanced dynamic. This indicates that fundamentals are becoming a more important factor, as various tokens that can demonstrate user engagement or revenue capacity are maintaining their value.

Key Takeaways for Investors

- The shift from liquidity-driven to fundamentals-driven market dynamics may influence investment strategies.

- Traditional reliance on speculative trading may be diminishing, with a focus now on sustainable assets.

- Current stability in tokens with institutional backing indicates a potential safe harbor for investors.

The ongoing assessment of these trends raises an important question: Will the current focus on fundamentals prevail over speculative trading patterns? As the market continues to evolve, investors would do well to monitor these shifts closely.