Nvidia Surpasses Earnings Forecast Despite Growing Bubble Concerns

Nvidia has reported impressive earnings, surpassing forecasts amid growing concerns about a potential artificial intelligence bubble. The company’s revenues reached $57 billion for the October quarter, marking a 62% increase year-over-year. This figure exceeded Wall Street’s expectations, which were set at $54.9 billion, highlighting sustained demand for AI chips.

Nvidia’s Financial Performance

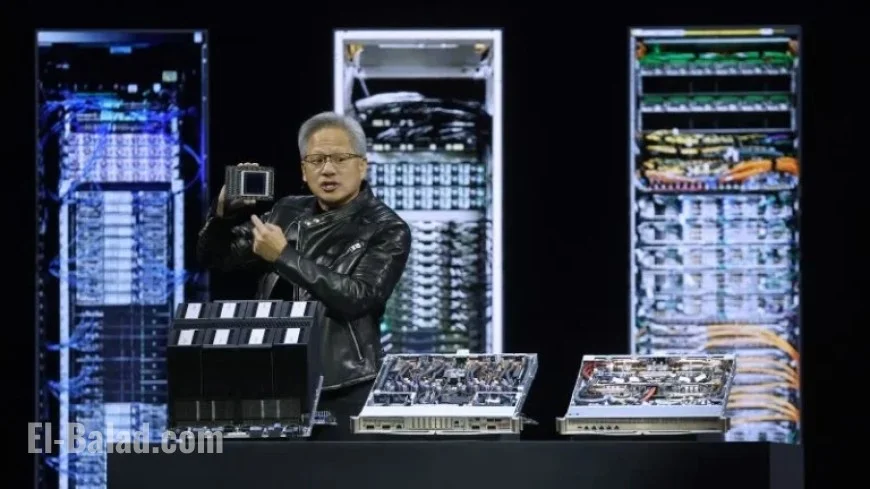

In addition to robust revenue, Nvidia’s profits rose 65% from the previous year to $31.9 billion, also slightly above analyst predictions. CEO Jensen Huang noted exceptional sales of AI products, stating, “Blackwell sales are off the charts, and cloud GPUs are sold out.” These comments counter fears regarding an AI bubble, suggesting strong ongoing demand.

Fourth Quarter Projections

The company has provided optimistic sales guidance of approximately $65 billion for the upcoming fourth quarter. This outlook reinforces the notion that AI investment is not slowing down.

Market Impact and Industry Influence

Nvidia’s stock (NVDA) experienced a 3.4% increase in after-hours trading following the earnings release. The company plays a pivotal role in the tech industry, contributing significantly to the stock market rally this year. Nvidia accounts for about 8% of the S&P 500 index, impacting numerous investors and 401(k) holders.

- Shares of other tech companies, including Meta, Microsoft, Amazon, and Google, rose in after-hours trading along with Nvidia’s report.

- Fears regarding an AI bubble had previously led to volatility in the market, prompting investors to shed riskier assets.

Expert Insights on AI Investment

Thomas Monteiro, a senior analyst at Investing.com, remarked, “This answers a lot of questions about the state of the AI revolution.” He believes the market is far from peaking in terms of demand and production capabilities. Analysts have raised concerns about circular funding arrangements, such as Nvidia’s $100 billion investment in OpenAI in September.

OpenAI’s CFO, Sarah Friar, recently suggested government support for tech debt related to AI infrastructure, a statement she later clarified. Still, deals continue to emerge, including a $30 billion commitment by Anthropic for computing capacity from Microsoft Azure that relies on Nvidia’s technology.

AI’s Economic Viability

At a recent conference, Huang asserted that the demand for AI tools indicates profitability, despite many companies reinvesting earnings into infrastructure. Major tech firms like Meta, Microsoft, Amazon, and Google have expressed intentions to increase their AI spending based on their quarterly earnings.

- Meta noted that AI recommendation systems are enhancing user engagement on platforms such as Facebook and Threads.

- Anthropic anticipates $7 billion in annual revenue this year, illustrating the economic viability of AI initiatives.

- Salesforce reported a 30% increase in engineering efficiency due to AI integration in their operations.

As Nvidia continues to navigate the landscape of AI advancements, its recent earnings performance signals strong growth potential amid evolving market dynamics and AI investments.