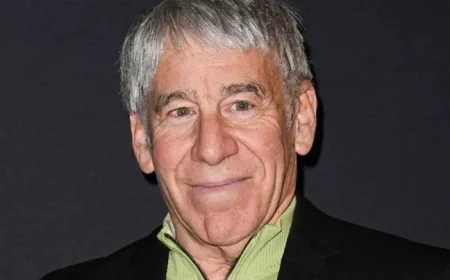

Michael Burry Targets Nvidia Following Strong Earnings Report

Michael Burry, the investor renowned for his role in “The Big Short,” continues to raise concerns about Nvidia, amid the chipmaker’s impressive earnings report. Despite Nvidia’s record revenue and optimistic growth forecast for the fourth quarter, Burry argues that AI stocks, including Nvidia, are caught in a bubble poised to burst.

Strong Earnings Report Boosts Nvidia’s Stock

Nvidia recently reported strong financial results, leading to a 5% rise in its stock during premarket trading. The company’s finance chief, Colette Kress, communicated confidence to investors, projecting approximately $0.5 trillion in revenue from its Blackwell and Rubin products throughout 2025 and 2026. Furthermore, she estimated that the annual expenditure on AI infrastructure could reach between $3 trillion and $4 trillion by 2030.

Nvidia’s Successes and Challenges

Nvidia’s CEO, Jensen Huang, addressed concerns about an AI bubble, claiming that the situation is much different than perceived. Kress highlighted the performance of Nvidia’s CUDA software, which enhances older chips’ capabilities. She stated that the A100 GPUs, launched six years ago, continue to be utilized effectively.

Burry’s Continued Critique

Burry, who has recently resumed his online presence, countered Nvidia’s positive narrative with a series of posts outlining his concerns. He emphasized that while older chips are still operational, their extension of useful life does not equate to profitability. He illustrated this with a comparison to airlines using older aircraft solely for temporary capacity boosts.

- Burry criticized Nvidia’s dependency on older technology, suggesting this could lead to inflated operational costs.

- He referred to an interconnected relationship between Nvidia and leading AI firms like OpenAI, Microsoft, and Oracle, questioning the true demand for their products.

- Highlighting stock buybacks, Burry reported that Nvidia has repurchased nearly $113 billion in shares since 2018 while increasing outstanding shares, suggesting significant dilution of earnings.

Comparisons to Historical Bubbles

Burry’s skepticism extends beyond Nvidia, drawing parallels between the current AI boom and the dot-com bubble of the early 2000s. He warns that companies heavily investing in AI technology may not recoup their massive investments. Recently, his hedge fund, Scion Asset Management, disclosed holding bearish put options on 1 million Nvidia shares and 5 million Palantir shares.

As Nvidia continues to navigate the complexities of a rapidly evolving AI landscape, Burry’s critical observations serve as a reminder of the risks involved in such investments. His return to the financial discourse is marked by a commitment to scrutinize the sustainability of AI growth amidst concerns of a looming bubble.