Nvidia Drops as Ray Dalio Warns of Market Bubble and Wealth Gaps

The stock market experienced volatility recently, with significant shifts observed in major indices. Early gains for the S&P 500 eroded by midday, resulting in a slight selloff. Nvidia, a leading player in the semiconductor sector, initially surged after releasing impressive earnings, but the stock reversed and declined by 1% as market sentiment weakened.

Nvidia’s Earnings and Market Response

Nvidia delivered eye-popping results for the third quarter, reporting a dramatic $57 billion in revenue. This figure represented a 22% increase from the previous quarter and a staggering 62% rise compared to the same quarter last year. The company’s data center revenue alone was recorded at $51.2 billion, reflecting a sequential growth of 25% and a year-over-year increase of 66%. Nvidia’s CEO, Jensen Huang, is optimistic about the demand for AI and projected revenue for the next quarter could reach around $65 billion.

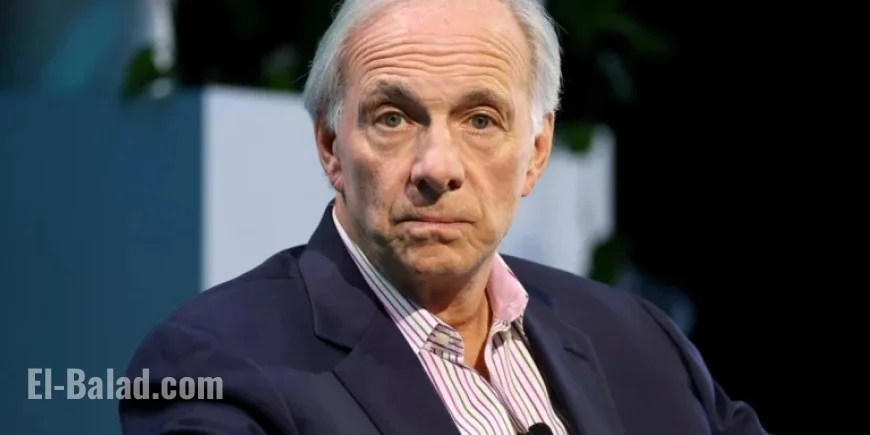

Ray Dalio’s Market Bubble Warning

Amid Nvidia’s success, billionaire investor Ray Dalio expressed concerns about the stock market dynamics. In a recent interview, he noted that many investors may misunderstand the underlying factors driving the rally. Dalio identified current market conditions as reminiscent of historic bubbles, although he cautioned that while valuations are high, the market has not yet seen a significant downturn.

Dalio emphasized the issue of wealth concentration, stating that the wealthiest 10% of Americans own nearly 90% of all equities. This concentration skews the economy, creating a K-shaped recovery where wealthier households prosper while lower-income families struggle.

- The wealthiest households are contributing to nearly all consumption growth.

- Federal Reserve data indicate a bifurcated economy, with spending disparities between upper-income and lower-income consumers.

- Margin debt has reached an all-time high of $1.2 trillion, posing additional risks in the market.

Economic Background and Investor Sentiment

Mixed economic data, including the cancellation of a jobs report, adds to market uncertainty. The Federal Reserve’s future monetary policy remains a significant concern for investors, especially in a landscape characterized by potential wealth taxes and tightening policies.

Despite these warnings, Dalio advises investors not to abandon their positions. He notes that bubbles can persist and even grow before they burst. His overarching message is one of caution—investors should remain aware of market risks and consider diversification strategies. He pointed to gold, which has reached new heights this year, as one potential hedge against market volatility.

Conclusion

As Nvidia continues to thrive amid the AI boom, Ray Dalio’s insights serve as a critical reminder of the broader economic fragility. Investors must navigate this complex landscape carefully, balancing the potential for gains with the inherent risks posed by concentrated wealth and market volatility.