Bitcoin Faces Longest Decline Since 2024 Amid Fed-Induced Rebound Adjustments

Bitcoin is currently experiencing its longest decline since June 2024, marking four consecutive weeks of losses. The digital currency is facing a price slump of 24.43% in the fourth quarter, a performance reminiscent of its worst showing in 2018. As it trades around $87,400, there appears to be cautious optimism due to recent market activity.

Market Dynamics and Trading Signals

A significant indicator in the spot market has reached its second-highest level this year, suggesting a possible bottom for Bitcoin prices. Despite this, options traders are preparing for further declines, especially by accumulating put options in the $80,000 to $85,000 range.

- Current Bitcoin price: $87,400

- Recent low: $82,100 (recorded on November 21)

- Change over the last 24 hours: approximately 1.8% increase

- Fourth quarter loss in percentage: 24.43%

Investor Sentiment and Federal Reserve Influence

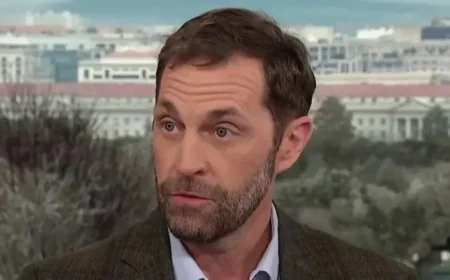

Sean Dawson, head of research at the analytics platform Derive, has shared insights into the market’s current state. He notes a spike in the spot bid-ask delta, indicating increased demand or dip-buying activity. However, he warns of potential bull traps, especially with the persistent negativity in market sentiment.

Despite these challenges, the probability of a Federal Reserve rate cut has risen dramatically from 40% to nearly 70%. This change could be influencing Bitcoin’s recent price movements. Dawson remains cautious, noting that fears of inflation persist, which may lead to a slower shift towards quantitative easing.

Future Outlook for Bitcoin

Dawson is cautiously optimistic about Bitcoin’s potential to reach $100,000 by the first quarter of 2026. However, he anticipates continued bearish trends for the remainder of 2025, as traders remain wary. The following key factors will likely determine Bitcoin’s trajectory:

- Pessimism in market sentiment

- Ongoing pressures on digital asset treasuries

- Federal Reserve’s monetary policies

Overall, while signs of recovery are evident, the market is fraught with uncertainty. The upcoming Federal Reserve meetings could significantly impact Bitcoin’s price direction as investors keep a close watch on monetary policy changes.