Bitcoin ATMs Rise Amid Global IPOs and Hong Kong Market Recovery

Bitcoin ATMs are experiencing significant growth as global consumer demand rises. This trend is underpinned by a resurgence in Hong Kong’s cryptocurrency market and ambitious international expansion plans by major digital asset firms.

Bitcoin ATM Installations on the Rise

The increase in Bitcoin ATM installations worldwide aligns with the goal of providing consumers with easy access to cryptocurrencies. The demand for user-friendly cryptocurrency transactions has prompted companies to expand their networks.

Hong Kong: A Crypto Hub

Hong Kong has become a dynamic center for digital asset companies. The city’s stock exchange raised approximately HK$216 billion (about $27.8 billion) through public listings in just the first ten months of this year. This figure represents a significant increase compared to the previous year.

- Growth: More than threefold increase from last year.

- Key Players: Bitcoin Depot is now the largest Bitcoin ATM operator globally.

- Reason: Crypto-friendly regulations and strong IPO activity attract global firms.

International Growth of Crypto Exchanges

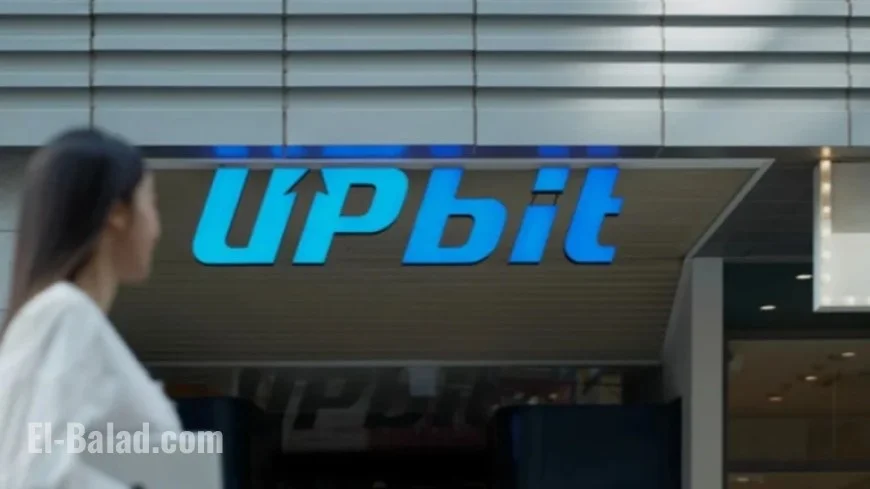

As volatility persists in domestic markets, major exchanges are exploring international capital opportunities. South Korea’s Dunamu, the parent company of Upbit, is on track for a Nasdaq listing. This merger with tech giant Naver aims to offer U.S. investors a unique entry into Asia’s busy crypto market.

- Upbit’s Trading Volume: Records about $2.1 billion in 24-hour trading.

- Bitkub’s Plans: Considering a $200 million IPO in Hong Kong.

- Market Factors: Political tensions and trade uncertainties drive firms to seek stability abroad.

Bridging Traditional Finance with Bitcoin ATMs

Bitcoin ATMs serve as a crucial link between traditional finance and the world of digital assets. Operators like Bitcoin Depot are expanding to meet everyday consumer needs, allowing users to convert cash to crypto easily.

- Accessibility: Bitcoin ATMs remove the complexities associated with online exchanges.

- Importance: Especially beneficial in areas with limited banking services.

Future of Cryptocurrency and Regulatory Changes

Recent regulatory adjustments in Asia have opened new pathways for stablecoin adoption and corporate digital currency initiatives. South Korea’s approval of bank-issued stablecoins, for example, indicates a shift toward innovation within the financial sector.

- Potential Impact: This development could reshape Korea’s digital finance landscape.

- Investor Signals: Growing accessibility to crypto assets marks a new era for digital currencies.

The Path Forward for Bitcoin ATMs and Crypto Exchanges

The future growth of Bitcoin ATMs and the aspirations of crypto exchanges are deeply connected. As markets evolve, physical ATMs will play a vital role in heightening consumer acceptance of cryptocurrencies.

Hong Kong’s resurgence as a vibrant crypto center, coupled with the expansion strategies of companies like Dunamu and Bitkub, indicates a promising trajectory for digital finance. This momentum reflects an industry adjusting to a dynamic market landscape and shifting consumer expectations, where digital currencies may soon become as commonplace as traditional cash.