Alibaba AI Soars 34% as China’s Commerce Rebounds

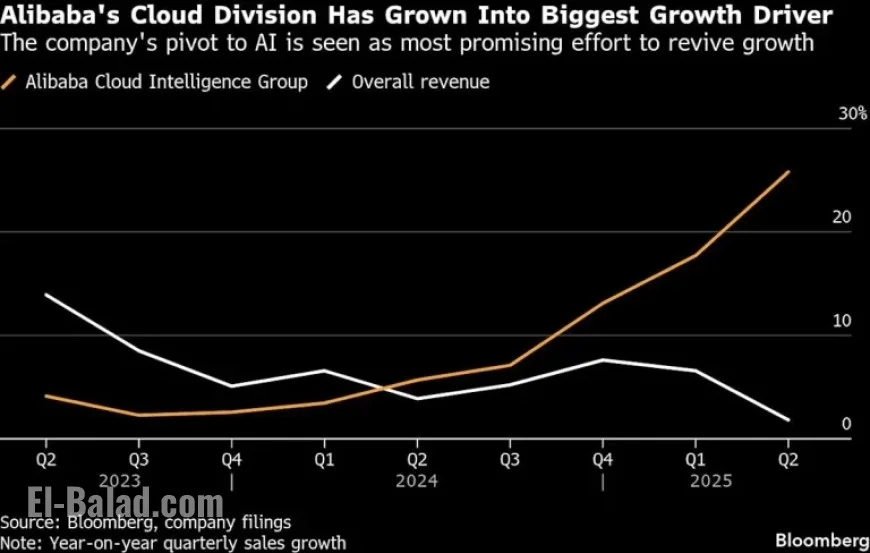

Alibaba Group Holding Ltd. reported a significant 34% growth in its cloud business, capitalizing on rising demand amid China’s artificial intelligence (AI) expansion. This growth helped elevate the company’s total revenue by 5%, reaching 247.8 billion yuan (approximately $35 billion) for the September quarter. This figure slightly surpassed market expectations.

Challenging Competitors in E-Commerce

The company experienced a 16% increase in Chinese e-commerce revenue, indicating strong performance against competitors such as JD.com and Meituan. In pre-market trading, Alibaba’s US shares rose by over 4% as investor confidence grew.

Impact of Investment in AI

Alibaba’s favorable results are expected to boost investor sentiment, particularly among those recognizing the company’s potential in AI. The firm has been accelerating the release of AI models, culminating in the relaunch of its Qwen mobile app. This effort aims to replicate the success of OpenAI’s ChatGPT, leveraging rapid user adoption.

Recently, Alibaba, alongside JD.com and PDD Holdings Inc., has reported better than expected earnings. These improvements have been supported by government stimulus and subsidies aimed at fostering consumer spending. However, this aggressive spending approach has affected Alibaba’s profitability, with net income falling to 20.99 billion yuan due to discounting and escalating AI development costs.

Investment Landscape and Competitive Edge

Alibaba’s investments in AI infrastructure have raised questions about sustainability, particularly amidst significant capital commitments by American tech giants like Amazon and Microsoft. While others have pledged hundreds of billions toward data centers, Alibaba’s investment of 380 billion yuan over three years stands out in the domestic landscape.

Despite the competitive pressure, Alibaba’s ambition remains firm. The revamped Qwen app saw an explosive adoption rate, with 10 million users in just four days. The app is designed to evolve into a comprehensive AI assistant capable of executing tasks such as online shopping on Taobao.

Challenges and Future Prospects

Alibaba’s growth is tempered by stringent US restrictions on advanced AI chip imports, which could hinder development. The company is also competing against formidable rivals in China. For instance, ByteDance’s Doubao chatbot boasts 172 million monthly active users, showcasing the competitive landscape.

Alibaba’s CEO, Eddie Wu, has outlined plans for a comprehensive suite of AI tools and the necessary infrastructure, including semiconductor development through its T-Head chip unit. Integrating instant delivery features into Taobao has attracted more users, but ongoing price wars and increasing competition have pressured profit margins.

Monitoring Long-Term Strategies

Investors will closely observe Alibaba’s ability to manage costs in consumer services while investing in cloud growth. The company faces a dual challenge of sustaining cloud revenue growth and navigating a competitive internet sector that includes various AI startups.

While Alibaba has made strides in the AI space, the path to sustained profitability remains complicated by external challenges and the evolving market landscape.