‘Trump Accounts’ explained: $6.25B pledge supercharges child investment program as launch details firm up

A sweeping new philanthropic pledge jolted momentum behind “Trump Accounts” on Tuesday, injecting $6.25 billion to seed 25 million children with starter balances as the federal program advances toward rollout. The one-time gift pairs with a previously enacted national framework that aims to give kids a market-based nest egg they can tap as young adults for school, a first home, or starting a business.

What are Trump Accounts?

Trump Accounts—sometimes described in policy briefs as Invest America accounts—are tax-advantaged investment accounts created for U.S. children under legislation passed earlier this year. The federal framework provides a Treasury seed deposit of $1,000 for eligible newborns within a defined window (children born January 1, 2025–December 31, 2028). Funds grow in stock index funds and similar vehicles and are generally accessible at age 18 for approved uses.

Key design points highlighted in official summaries:

-

Automatic seed for eligible babies: $1,000 from Treasury at account creation.

-

Annual contributions: Parents and family can add up to $5,000 per year, with a portion potentially routed via employers on a tax-advantaged basis.

-

Long-term investing: Assets are directed to diversified stock funds; withdrawals are restricted to education, first-time home purchase, entrepreneurship, and other qualified milestones.

-

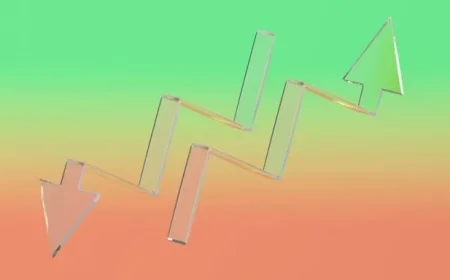

Projected growth: Even without extra deposits, government illustrations show balances compounding meaningfully by ages 18–28, though market returns are not guaranteed.

What changed today

A major philanthropic couple pledged $6.25 billion to deposit $250 each into 25 million children’s accounts. The private funding is intended to widen access—reaching kids who fall outside the federal newborn window or who live in lower-income ZIP codes where families may be least able to contribute on their own. Coordination with Treasury and approved financial institutions is expected so these deposits can arrive automatically once accounts are verified.

Why it matters:

-

Scale: Reaching 25 million kids would cover a large majority of U.S. children under 10.

-

Equity: The outside funding targets communities that historically build less wealth for children.

-

Momentum: The gift could spur matching campaigns by employers, cities, and philanthropies.

Timeline and how claiming will work

-

Program launch: Federal agencies have indicated a target launch around July 4, 2026, to open and begin funding newborn accounts created during the eligible birth window.

-

Account setup: Families of eligible babies will make an election to open the account (details to be published prior to launch). Identity and residency verification will be required.

-

Philanthropic deposits: The $250 contributions are expected to flow after an account is established and matched to a qualifying child under the private program’s rules (geography and age criteria to be finalized).

-

Portability: If a family moves, the account remains with the child; recordkeeping follows standard custodial account practices.

Who’s eligible now—and who isn’t (yet)

-

Eligible now (federal seed): Babies born 2025–2028 once the system goes live and a parent/guardian opts in.

-

Likely eligible for $250 gift: Children under age 10 in targeted ZIP codes or broader cohorts the donors designate. Expect clearer eligibility maps ahead of the rollout.

-

Not yet covered: Children outside those age/geography rules, and newborns before 2025 without separate philanthropic support.

Guardrails, fees, and investment options

-

Investments: Low-cost index funds and similar diversified vehicles; families won’t be picking individual stocks.

-

Fees: Program materials emphasize low-fee options; exact fee tables will be disclosed by participating providers.

-

Withdrawals: Restricted to qualified purposes; early nonqualified withdrawals could face taxes/penalties.

-

Ownership and protection: Accounts are held for the child’s benefit with standard custodial safeguards.

What families can do now

-

Gather documents: Birth certificate, Social Security numbers, and proof of address will streamline enrollment once portals open.

-

Check employer benefits: Some companies may offer payroll contributions that don’t count as taxable income up to a defined cap.

-

Plan contributions: Even small, regular deposits can materially boost the balance by age 18 thanks to compounding.

-

Watch for eligibility notices: Expect outreach from schools, pediatric clinics, and local governments as pilot communications begin.

FAQs about Trump Accounts

-

Is this guaranteed money? The federal $1,000 seed for eligible newborns is statutory; market growth is not guaranteed. The $250 philanthropic deposits are committed funds, delivered once eligibility and account setup are confirmed.

-

Can I use funds for anything? No. Withdrawals are restricted to qualified uses like education, first home purchase, or starting a business at/after the eligible age.

-

What if my child isn’t an eligible newborn? You may still qualify for the $250 gift if your child meets the private program’s criteria (age/location). Additional public or private expansions are possible.

-

Will this affect other benefits? Asset tests vary by program; implementing agencies are expected to clarify interactions with means-tested benefits before launch.

The federal Trump Accounts initiative was already poised to give millions of newborns a head start; today’s $6.25 billion gift dramatically extends that reach to older children—especially in communities where intergenerational wealth-building lags. Families should track forthcoming enrollment instructions and consider regular, affordable contributions to make the most of compounding over the next decade.