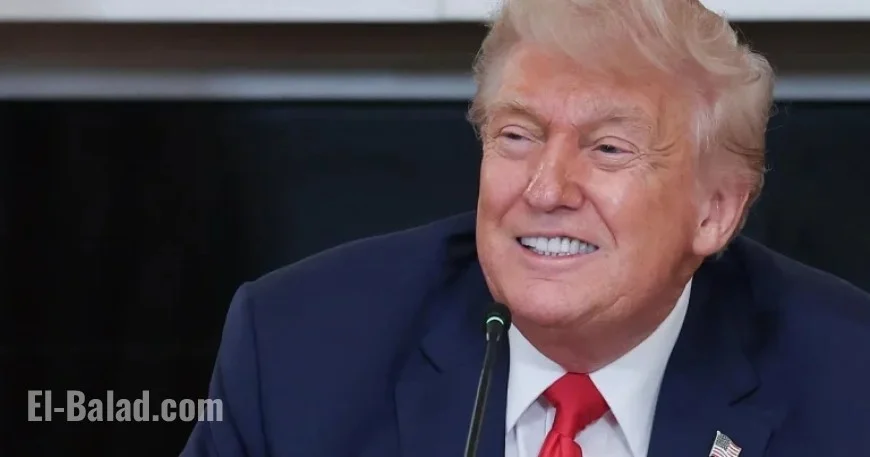

Dell Donation: How Trump’s Kids’ Accounts Will Operate and Key Details

The recent introduction of Trump accounts has sparked interest among families considering long-term investment options for their children. These accounts, designed as a new tax-deferred vehicle, aim to facilitate savings for U.S. children, offering significant government contributions. Understanding the specifics of these accounts is essential for potential beneficiaries and their families.

Dell Donation: How Trump’s Kids’ Accounts Will Operate

Trump accounts are part of a tax and spending initiative established under President Trump’s legislation. Eligible U.S. children, specifically those born between January 1, 2025, and December 31, 2028, can benefit from this program. Here’s what families need to know.

Eligibility Criteria

- Children born between January 1, 2025, and December 31, 2028, are eligible.

- Households of any income level can open an account.

- Parents, friends, and employers can contribute to these accounts.

- Families with children under 18 can also open accounts, but they will not receive initial government contributions.

Setting Up a Trump Account

Parents or guardians are responsible for establishing and managing the account until the child reaches adulthood. To initiate the process, households must complete IRS Form 4547, which also allows them to request the one-time $1,000 government contribution. This initial funding is deposited at account activation.

Timeline for Account Establishment

Families can set up a Trump account beginning in early 2026, with contributions commencing on July 4, 2026. Account holders should expect instructions from the Treasury Department the following May for activating their accounts.

Contribution Limits

- A total of $5,000 can be deposited annually per child, not including the initial $1,000 contribution.

- Employers may add up to $2,500 each year to an employee’s Trump account under tax-free conditions.

- Contributions from government entities and nonprofits generally do not count towards the annual limit.

- Annual contribution limits will be indexed for inflation starting in 2028.

Withdrawal Restrictions

Funds in a Trump account cannot be accessed before the child turns 18, except in specific situations such as account rollovers or upon the death of the beneficiary. After turning 18, withdrawals will adhere to standard IRA regulations.

Investment Options

Funds in Trump accounts must be directed towards authorized investments like mutual funds or exchange-traded funds linked to major stock indices. Notably, the annual fees charged by financial firms cannot exceed 0.1%.

Comparing Trump Accounts to Other Savings Plans

Financial experts suggest evaluating other savings vehicles, such as 529 plans, which offer tax advantages for education expenses. While Trump’s accounts do provide a government contribution, they have limitations in flexibility and tax benefits compared to 529 plans.

- 529 plans allow tax-free growth and withdrawals for educational expenses.

- They provide options for transferring funds to IRAs, enhancing long-term financial strategies.

In a significant announcement, philanthropists Michael and Susan Dell pledged a total of $6.25 billion to broaden support for children utilizing Trump accounts. This generous contribution reflects a growing interest in fostering financial security for future generations.

While Trump accounts offer a gateway for government-backed savings, families are encouraged to weigh all available options for enhancing their financial futures effectively.