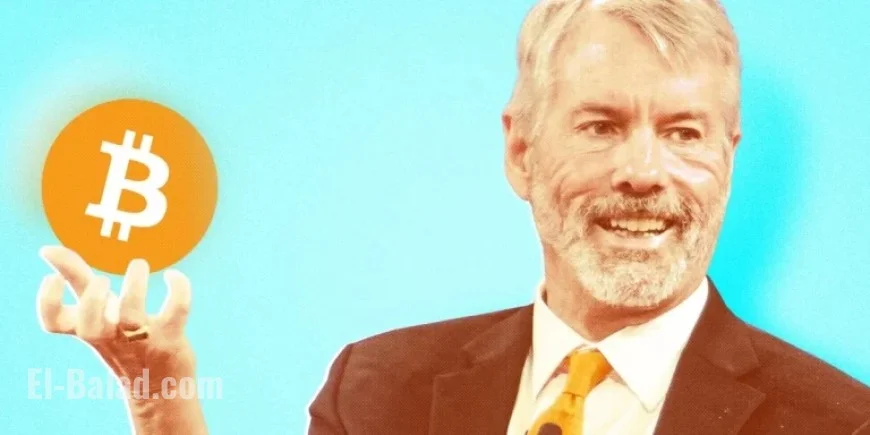

Michael Saylor’s Strategy Tested as MSTR Shares Plummet

Billionaire Michael Saylor faces a significant challenge as his firm, Strategy, experiences a sharp decline in share prices. The company, which controls over 3% of the world’s Bitcoin, is grappling with a bearish crypto market and impending regulations that threaten its stock viability.

Share Price Decline and Financial Pressures

Strategy has reported a drastic downturn, with its shares plummeting approximately 50% since October 1. The financial giant MSCI proposed a rule change that could exclude Strategy from popular indices, set to take effect in February, potentially triggering a selloff worth over $8 billion.

- Strategy’s share price is significantly affected by market awareness of MSCI’s impending rule.

- The firm’s mNAV, measuring share value against Bitcoin holdings, has recently fallen below one.

- In a bid to secure itself against upcoming financial obligations, Strategy announced a reserve fund of $1.2 billion.

Criticism and Controversy

Critics argue that Strategy’s business model, which involves issuing stock to buy Bitcoin, is unsustainable. Notably, detractors suggest that Saylor’s approach resembles a Ponzi scheme. Despite this, some defend him as a pioneer navigating the complexities of crypto finance.

- Strategy’s model has faced scrutiny, with accusations of deception.

- Financial obligations, including $200 million in dividends due by December 31, burden the company.

Potential Bitcoin Liquidation

Amid speculations about a potential Bitcoin selloff, TStrategy’s CEO hinted at this as a possibility. Such a move could exacerbate market instability, affecting numerous companies following a similar investment strategy.

Investments and Bitcoin Holdings

As of late November, Strategy acquired an additional 130 Bitcoin, increasing its total to 650,000 coins, valued at approximately $58.5 billion. Saylor’s company has spent around $48.4 billion on Bitcoin, averaging $74,436 per coin.

- Strategy holds 3.1% of Bitcoin’s total supply of 21 million.

- Saylor emphasizes the company’s intention to keep acquiring Bitcoin, despite market pressures.

Market Reactions and Future Outlook

The recent developments have fueled skepticism among market observers. Some analysts see the current situation as critical for determining Strategy’s future. The upcoming months will reveal whether Saylor’s long-term vision succeeds or falters under financial pressure.

As Strategy navigates this turbulent landscape, its ability to adapt and manage its Bitcoin holdings will be closely watched, shaping the broader narrative of the cryptocurrency market.