Housing Crisis Forces Americans to Choose: Affordability vs. Safety

The U.S. housing crisis is forcing Americans to make a difficult choice: affordability versus safety. As residential property prices soar, many face the dilemma of high costs in safe areas versus lower prices in risky locations.

The Housing Affordability Crisis

The current median home price in California stands at approximately $906,500, a steep increase of 82% in mortgage rates since January 2020. In contrast, the median price for a similar home in Texas drops to about $353,700. However, homes in Texas are often located in areas prone to natural disasters like hurricanes and flooding.

Migration Trends

Migration patterns reveal stark realities. California lost 239,575 residents in 2024, marking the largest outflow of any state. Many displaced individuals are relocating to southern and western states, particularly Texas and Florida, in search of more affordable housing.

- California’s median home price exceeds double the national average.

- Texas saw a net gain of 85,267 people in 2024.

- An annual income of about $237,000 is required to qualify for a mid-tier California mortgage.

Income and Housing Affordability

Over 21 million renter households in the U.S. spent more than 30% of their income on housing costs in 2023. This financial strain pushes many into high-risk environments. The interconnection between income and disaster exposure is becoming increasingly evident.

The Risk of Climate Change

The regions attracting new residents are not necessarily safe. High-fire-risk counties experienced an influx of 63,365 people in 2023, many moving to Texas. Low-income families and minority communities are particularly vulnerable when disasters occur, facing significant barriers in recovery efforts.

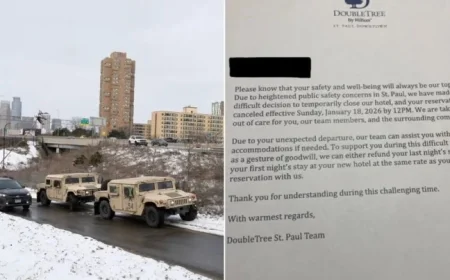

Insurance and Housing Policies

A brewing insurance crisis adds further complication. Many insurers in states like Florida and Texas have collapsed, unable to handle the rising number of claims from severe weather events. From 2018 to 2023, almost 2 million homeowner policies were canceled nationwide, a rate four times higher than historical averages.

The Role of Policy

This crisis reflects a significant policy failure. California aims to construct 2.5 million new homes by 2030 but only completed approximately 100,000 in 2024. Local governments often restrict housing development, forcing families into riskier areas.

- Only 100,000 homes were built in California in 2024.

- Exclusionary zoning practices hinder affordable housing development.

Conclusion: Addressing Housing Scarcity

The federal government has begun to acknowledge the need for integrating social vulnerability into disaster planning. However, there is a need for decisive action to ensure that housing remains a right, not a gamble based on geographic risk.

Until policymakers address the core issues of housing scarcity and the safety of communities, the impact of climate change will disproportionately affect those struggling most to find safe and affordable homes.