The Scale of AI Investment Surges to New Heights

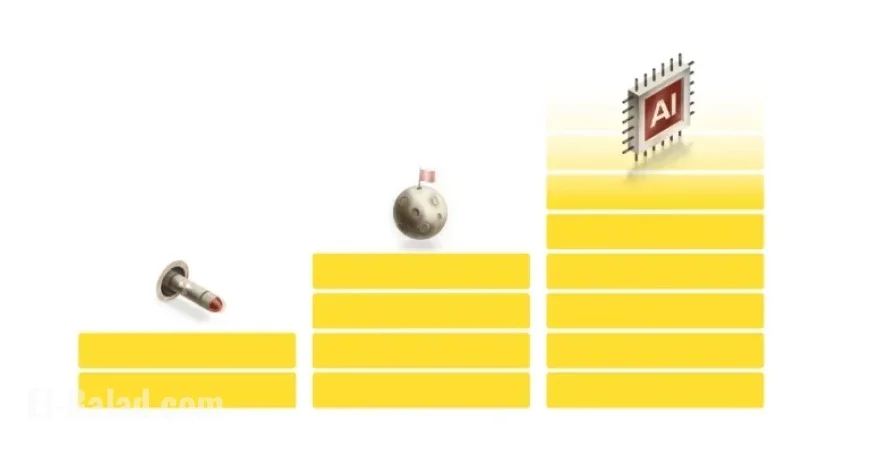

Investment in artificial intelligence (AI) is reaching unprecedented levels, surpassing historical government-led initiatives and previous technology booms. Funding for AI has exceeded that of notable projects like the Manhattan Project and the Apollo Program and has outpaced capital investments from the dot-com bubble and cryptocurrency surge.

The Scale of AI Investment Surges to New Heights

In 2024, global private investment in AI infrastructure alone amounted to $37 billion, according to Stanford University’s AI Index Report. This extraordinary influx of capital is concentrated in a very short timeframe, reshaping the global technology landscape.

Key Areas of Investment

- Natural Language Processing

- Healthcare Technology

- Autonomous Vehicles

- Financial Technologies

- Manufacturing Innovations

More than 500 large data centers have been constructed between 2021 and 2024. These facilities can be as expansive as several American football fields. Although beneficial to local economies, they raise significant concerns regarding resource consumption, including land, water, and energy.

Future Projections

According to McKinsey, an investment of $5.2 trillion in data centers will be essential by 2030 to fulfill the growing demand for AI technologies. The tech sector is making substantial investments; the so-called “Magnificent Seven” companies—Alphabet, Amazon, Apple, Meta, Microsoft, Nvidia, and Tesla—are expected to spend over $300 billion on AI by 2025.

The Implications for Startups and Valuations

In the first quarter of this year, AI startups raised over $70 billion globally, accounting for nearly 60% of all venture capital financing. These enormous sums have driven the valuations of AI firms to remarkable heights. Notably, Nvidia’s market value surged more than tenfold since the emergence of ChatGPT, reaching nearly $4.5 trillion.

Concerns Amidst the Boom

Despite the soaring investment and valuations, skepticism remains regarding the actual profitability of these firms. While revenues have increased, they have not kept pace with inflated market valuations. Experts like Carnegie Mellon University’s Bryan Routledge view current stock prices as speculative, often disconnected from immediate cash flow realities.

Concerns have been raised regarding interconnected financing among tech firms, where companies invest in their own customers to create the illusion of organic growth. This circular financing can inflate company valuations and present challenges for investors, as observed during a pullback in tech stocks highlighting underlying vulnerabilities.

Historical Comparison of Investment Scales

| Technology | Investment (Inflation-Adjusted) |

|---|---|

| Railway Mania | $3 trillion |

| Telecom Investments | $1 trillion |

| AI Investments (2013-2024) | $1.6 trillion |

While AI investment could match historical technology booms like shipping canals and railroads, its rapid pace raises questions about the long-term sustainability and potential risks of a financial bubble. The road ahead remains uncertain, but the AI surge shows no signs of abating.