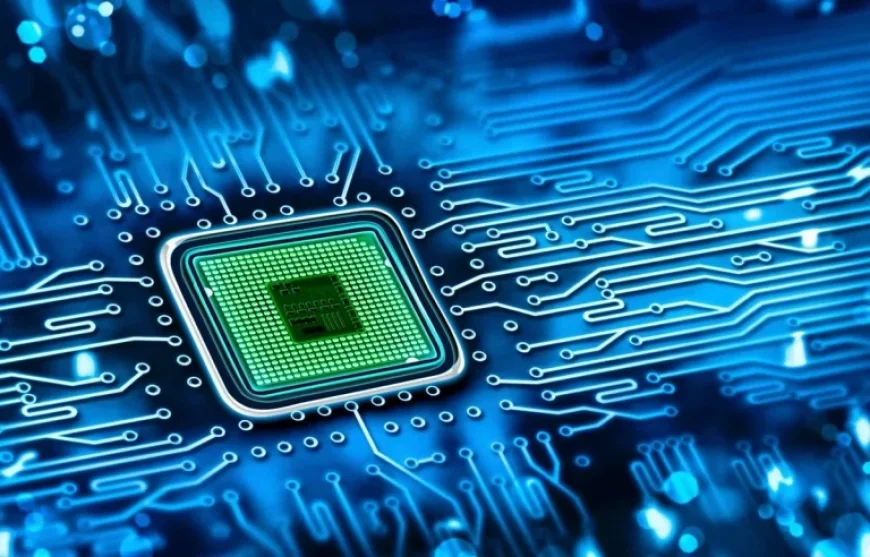

AI Chip Stock Poised to Surpass Nvidia by 2026

Micron Technology is emerging as a significant contender in the artificial intelligence (AI) chip market, poised for substantial growth by 2026. Traditionally dominated by Nvidia, this sector is experiencing rapid transformations fueled by advancements in high-bandwidth memory (HBM).

Understanding High-Bandwidth Memory (HBM)

HBM is a specialized type of dynamic random access memory (DRAM) that enhances the performance of graphics processing units (GPUs) used in training large language models (LLMs) and running AI inference. This technology enables GPUs to manage data more efficiently, utilizing a method known as 3D stacking.

Market Demand and Supply Shortages

The demand for HBM has surged, significantly impacting the DRAM industry. As HBM requires three to four times more wafer capacity than traditional DRAM, this discrepancy has led to shortages and soaring prices in the market.

Micron Technology’s Strategic Position

Micron Technology is predominantly known as a DRAM leader, with around 80% of its revenue sourced from DRAM and 20% from NAND flash memory. Given the current climate of demand and supply constraints, Micron is well-positioned for revenue growth and margin expansion.

Impressive Financial Performance

- Fiscal first quarter revenue increased by 57%.

- Adjusted earnings per share (EPS) surged nearly 170% to $4.78.

- Adjusted gross margin climbed from 39.5% to 56.8% year-over-year.

Future Projections and Expansions

Micron anticipates the HBM market will grow at an annual rate of 40%, potentially reaching a value of $100 billion by 2028. In response to this demand, the company has increased its capital expenditure budget from $18 billion to $20 billion and plans to establish new manufacturing facilities.

- New chip fab in New York to commence construction early this year.

- Expected operational readiness of a new Idaho fab by 2027.

- Initiation of a second fab project in Idaho planned for this year.

Continued Growth in AI Chips

The rising demand for AI chips, paired with the necessity for HBM, positions Micron to benefit from the ongoing supply constraints. The company currently has its supply fully booked and is expected to gain from rising price trends.

Financial Health and Market Position

Micron has been generating strong free cash flow, resulting in a net cash-positive balance sheet. While it may not possess the brand strength of Nvidia, the current market dynamics suggest that Micron is set to outperform by 2026.

As it navigates the evolving landscape of AI chips and the persistent demand for HBM, Micron Technology is carving a promising path for the future. Investors and industry observers alike should monitor this growth story closely as it unfolds.