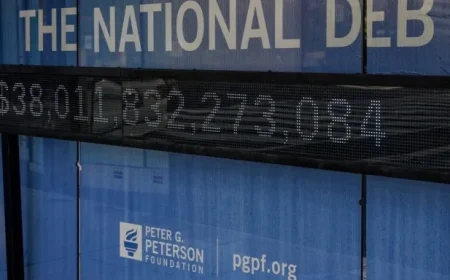

Fed’s Preferred Inflation Indicator Climbs to 2.8% in September

The Federal Reserve’s preferred inflation gauge, the personal consumption expenditures (PCE) index, indicated a 2.8% increase in September compared to the same month last year. This data was released on a Friday and slightly fell short of analysts’ expectations, which projected a 2.9% rise.

Understanding the PCE Index

The PCE index is crucial as it reflects consumer spending patterns on goods and services. It comprises approximately two-thirds of total national spending, playing a vital role in the overall economic output.

Core Inflation Insights

Core inflation, which excludes the often-volatile categories of food and energy, experienced a 0.3% increase from the previous month. Despite this rise, personal spending remained stagnant in September. However, when food and energy costs are excluded, spending saw a modest uptick of 0.2% from August.

Economic Forecasts and Trends

- Analysts at Capital Economics noted the unchanged real consumption in September.

- They revised down August’s real spending growth from 0.4% to 0.2%.

- A decline in motor vehicle sales is projected to further impact spending in October.

- Overall consumption and GDP are expected to decelerate in the fourth quarter.

Consumer Spending Patterns

Despite indications of a slowdown in consumer spending, recent data following Black Friday shows that consumers continued to make significant expenditures. This information comes as the Federal Reserve is set to meet for its next interest rate discussion on December 9-10.

Interest Rate Outlook

The central bank is anticipated to lower interest rates again. However, Fed policymakers are currently divided on whether to prioritize inflation or labor market conditions. Notably, inflation has been on the rise every month since April.

Upcoming Economic Data Releases

Due to a recent government shutdown, new data is not expected until December 18, which will be after the Fed’s interest rate meeting. Additionally, the next official jobs report is scheduled for release on December 16 and will arrive too late for consideration in the upcoming meeting.

Job Market Concerns

Earlier in the week, a jobs report from ADP indicated a net loss of 32,000 jobs in November, primarily affecting small businesses. Moreover, layoffs in November reached the highest levels since the onset of the COVID-19 pandemic, according to data from Challenger, Gray & Christmas.