Netflix CEO Dismisses Paramount Offer, Confident in WBD Deal Success

Netflix has made headlines with its ambitious announcement of an $82.7 billion deal to acquire a substantial portion of Warner Bros. Discovery (WBD). As Paramount Skydance put forth a rival offer for the entire WBD, Netflix’s executives expressed unwavering confidence regarding their own agreement during a recent UBS conference.

Confidence Amid Competition

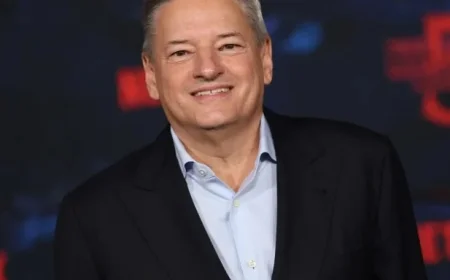

Ted Sarandos, Co-CEO of Netflix, dismissed the rival bid from Paramount, stating, “Today’s move was entirely expected.” He emphasized that Netflix’s deal is advantageous for shareholders as well as consumers. Sarandos also reassured the audience, reiterating, “We have a deal done, and we are incredibly happy with the deal.”

Future Plans for WBD

Fellow Co-CEO Greg Peters highlighted a three-phase strategy aimed at maximizing value from Warner Bros. and HBO. He outlined plans to:

- Enhance licensing opportunities

- Strengthen the HBO brand

- Utilize Warner Bros.’ extensive library of intellectual property

Despite a drop of 6% in Netflix stock following the announcement, the executives remain optimistic. Sarandos acknowledged Netflix’s historical focus on developing original content rather than acquiring companies.

Impact on the Entertainment Industry

The deal has raised concerns among Hollywood stakeholders, including creators and unions. Many see it as a potential threat to traditional business models. Sarandos attempted to ease these concerns, stating, “We didn’t buy this company to destroy that value.” He assured theater owners that Netflix remains committed to theatrical releases.

Job Creation and Economic Contributions

During the conference, Sarandos highlighted Netflix’s contributions to American employment. He noted that Netflix original productions have employed up to 140,000 people from 2020 to 2024, injecting approximately $125 billion into the U.S. economy.

Netflix has collaborated with around 500 independent production companies and embarked on nearly 1,000 original projects. Unlike Paramount’s offer, which may involve job cuts due to overlapping operations, Sarandos asserted that Netflix is focused on job creation.

Regulatory Considerations

As discussions about the acquisition unfold, both Netflix leaders addressed potential antitrust concerns. They argued that the combined market share of Netflix and HBO would still fall behind other streaming giants like YouTube.

Peters indicated that using Nielsen data shows Netflix would control only 9% of U.S. TV hours post-acquisition, compared to combined competitors. An analysis by BofA Research categorized that Netflix and Warner would command about 21% of the total streaming market, still trailing behind YouTube.

The Path Forward

As the deal progresses, Sarandos expressed enthusiasm, stating that it’s beneficial for shareholders, consumers, and creators, as well as the overall entertainment industry. With ongoing discussions and strategic planning, Netflix is positioning itself for significant growth in the competitive media landscape.