Trump Administration to Enhance Corporate Tax Breaks

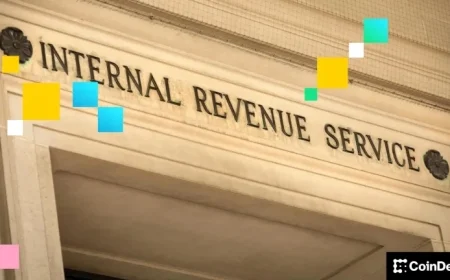

The U.S. Treasury Department is on the verge of unveiling a significant corporate tax workaround. This guidance could benefit major companies such as Salesforce Inc. and Qualcomm Inc. Reports suggest that the Treasury will address a pressing tax issue as early as next week.

R&D Tax Breaks in Focus

The upcoming tax guidance aims to help corporations fully utilize the generous research and development (R&D) tax breaks outlined in President Donald Trump’s tax legislation. This bill, often referred to as “One Big Beautiful Tax Bill,” has faced challenges due to the 15% minimum tax imposed during the Biden administration.

Addressing Corporate Concerns

Under the Biden-era law, companies that earn at least $1 billion face limitations when claiming R&D deductions. The new guidance is expected to resolve this issue, which has been a concern for major corporations and their lobbyists.

- Companies like Airbnb Inc., Broadcom Inc., and Applied Materials Inc. may be significantly impacted.

- The Treasury’s changes could help firms avoid the minimum tax that arises from taking large R&D deductions, estimated at $67 billion.

- Research-heavy sectors such as technology and pharmaceuticals stand to gain from these adjustments.

Previous Legislative Context

The prior tax reform legislation restored full upfront deductions for R&D investments and made permanent various tax breaks, including those for loan interest and equipment purchases. Additional benefits include expansions on state and local (SALT) deductions.

Recent Developments from the Treasury

In recent months, the Treasury has made several adjustments to ease the impact of the corporate minimum tax. These changes have included:

- More lenient regulations regarding the tax application.

- Exemptions for specific industries, such as insurance and utilities.

- Allowing unrealized cryptocurrency gains to be excluded from the minimum tax calculation.

Experts note that the Treasury’s leeway to implement these modifications stems from the congressional decision that established the corporate minimum tax. However, it remains uncertain if the forthcoming guidance will also address the complexities related to international tax rules from Trump’s administration.

Political Reactions and Future Implications

The planned guidance is likely to meet with criticism from progressive Democrats, particularly Senator Elizabeth Warren. She has been vocal against attempts to curb the corporate minimum tax.

The anticipated changes signify a continued trend of providing tax benefits for large corporations and underscore the ongoing significance of tax policy in the current economic landscape.