Is the Dollar About to Decline Again?

In recent months, the performance of the Dollar has attracted significant attention. Earlier this year, discussions surrounding the currency intensified following the introduction of reciprocal tariffs in April. This led to heightened bearish sentiment, with some experts warning about a potential capital outflow from the United States and questioning the Dollar’s status as the world’s reserve currency. However, these predictions have not materialized.

Current State of the Dollar

This week, the Federal Reserve’s decisions led to a noticeable decline in the Dollar, dropping approximately 1% since the meeting. The key question remains: is this a precursor to a larger decline, or merely temporary market fluctuations?

Understanding the DXY Index

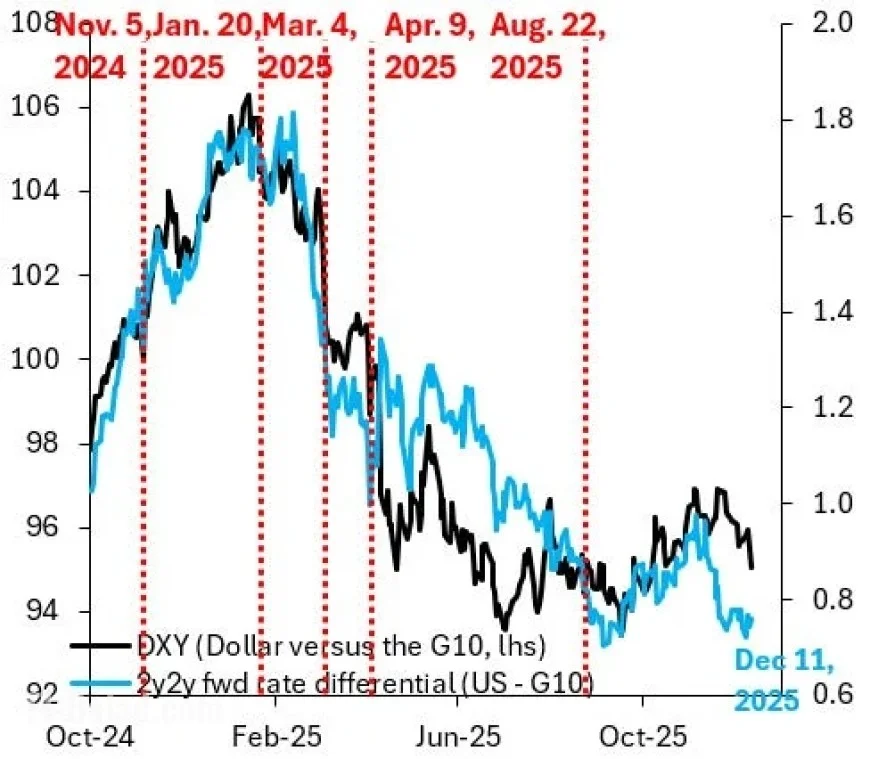

To analyze the Dollar’s movements, one can refer to Bloomberg’s DXY index. This index measures the trade-weighted strength of the Dollar against a basket of six major currencies. For context, the 2y2y forward rate differential of the U.S. is also crucial in understanding market dynamics.

Comparative Analysis

- Post-tariff rollout, the Dollar exhibited a sharper fall compared to the 2y2y forward differential.

- This scenario drew comparisons to the UK’s bond market crisis in late 2022, where the Pound decreased despite rising yields.

- Currently, the situation has reversed: the forward rate differential is decreasing while the Dollar remains stable.

Reasons for Dollar Resilience

Several factors contribute to the Dollar’s current resilience. Firstly, the extreme negativity surrounding the Dollar earlier this year has subsided. The anticipated declines failed to materialize, resulting in caution among market participants regarding further Dollar weaknesses. Rather, there appears to be a growing bias towards maintaining long positions on the Dollar.

Conclusion

In summary, the Dollar does not appear to have much room for further decline. As market sentiments shift and concerns about the currency dissipate, traders seem more inclined to consider potential upsides. The narrative of the Dollar’s downfall has grown stale, and markets are increasingly looking beyond past uncertainties.