US Supports Korea Zinc’s $7.4 Billion Critical Minerals Plant

Korea Zinc Co. has announced plans to construct a critical minerals plant in the United States, with a budget of approximately $7.4 billion. This ambitious project is supported by the U.S. government and other investors, intending to strengthen supplies of essential materials used in chip-making, defense, and aerospace industries.

Korea Zinc’s Strategic Initiative

The initiative underscores Korea Zinc’s role as a leading smelter of zinc globally. The company’s move aligns with the ongoing efforts by the U.S. and its allies to secure stable supply chains for critical minerals.

Crucible JV LLC Formation

On Monday, Korea Zinc’s board approved the establishment of a foreign joint venture named Crucible JV LLC. The venture will receive around $1.94 billion in funding from the U.S. government, strategic investors, and Korea Zinc itself.

Existing Smelting Capacity

The U.S. currently operates only one major zinc smelter, managed by Nyrstar USA, a part of the Trafigura Group. Nyrstar is expected to sell its Clarksville, Tennessee facility to Korea Zinc for an undisclosed amount.

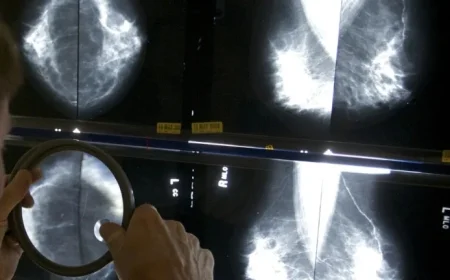

New Facility and Capabilities

Korea Zinc aims to develop a state-of-the-art, fully integrated smelting facility at the Clarksville site. The plant will have the capacity to refine various metals, including:

- Zinc

- Lead

- Copper

- Gold

- Silver

Additionally, it will process strategic minerals such as:

- Antimony

- Germanium

- Gallium

Geopolitical Context

Last year, China imposed an export ban on these strategic minerals, which are vital for products like semiconductors and satellites. This action was part of a broader dispute related to U.S. technology policies targeting Beijing. Despite previous regulatory rollbacks on electric vehicle (EV) incentives, securing alternative sources of critical minerals has become a priority for Washington.

Positioning for National Security

By expanding its U.S. smelting and processing capabilities, Korea Zinc aims to position itself as a key player in national security, expanding its role beyond just the electric vehicle market. The company’s first U.S. venture is a strategic move given the geopolitical climate and the increasing demand for stable supply chains.

Ownership Dispute

Korea Zinc’s expansion pushes forward amid an ongoing ownership dispute that has affected the company. The conflict began last year when its largest shareholder, Young Poong Corp., and MBK Partners Ltd. made an unsolicited takeover bid for control of the firm.