Governor Miran Addresses Inflation Outlook in Key Speech

Governor Miran recently addressed the public in a significant speech regarding the inflation outlook. During this address, he provided an in-depth analysis of the components driving inflation and their implications for achieving a 2 percent target.

Inflation Outlook Breakdown

Miran highlighted the complexities of measuring shelter inflation, a substantial part of overall inflation indices. The personal consumption expenditures (PCE) price index, which the Federal Reserve targets, includes housing costs across all households. This approach captures consumer spending well but may lag behind current supply and demand realities.

Key Factors Influencing Shelter Inflation

He explained that the demand for housing surged post-pandemic, causing new market rents to rise sharply. However, the PCE shelter index adjusted more slowly, leading to an uncertainty about the duration of elevated shelter inflation. Recently, indicators suggest that the inflation rates for rental properties are beginning to align, indicating a potential decline in shelter inflation. This decline is expected due to:

- A negative population shift while net migration has reversed.

- A high consumption ratio of nominal shelter services compared to overall consumption.

Core Nonhousing Services Inflation

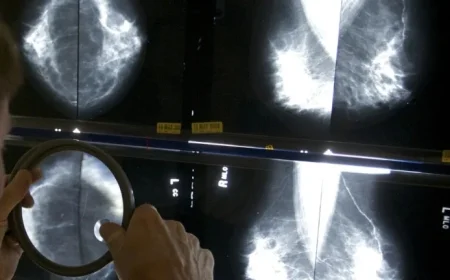

The governor also discussed core nonhousing services inflation, which constitutes approximately half of household spending. This segment comprises essential services such as childcare, education, and healthcare. Miran noted that this inflation has remained stable yet above the pre-2008 average.

Factors Affecting Nonhousing Services

Wage growth primarily drives service costs, and recent trends in the labor market indicate a loosening situation, which may ease upward pressures on service prices. Inflation in this category, influenced by labor costs, is crucial to monitor.

Core Goods Inflation Concerns

Turning to core goods, Miran observed that prices saw a significant boost in recent months. While some analysts attribute this surge to U.S. tariff policies, he remains skeptical, emphasizing that various factors interact in a complex economic landscape.

- Historical trends indicate that core goods inflation has fluctuated.

- Potential noise in the data complicates the understanding of present inflation trends.

Global Comparisons and Future Predictions

When comparing U.S. inflation rates to those in other industrialized nations, he noted that the U.S. does not stand out significantly. This observation brings to light the need for careful consideration of the broader economic context when analyzing inflation drivers.

Future Monetary Policy Recommendations

Looking ahead, Miran suggested that current high interest rates may not be sustainable if inflation metrics—particularly those from housing services—continue to normalize. He emphasized a more proactive monetary policy approach could achieve better economic stability.

In summary, Miran’s remarks call for vigilance in interpreting inflation data, advocating for a focus on underlying economic conditions rather than temporary price fluctuations. Such strategies could guide monetary policy towards achieving long-term economic health.