Tricolor Executives Charged with Fraud Amid Subprime Auto Lender Bankruptcy

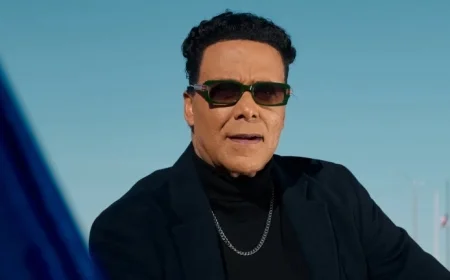

Federal prosecutors have charged executives from the subprime auto lender Tricolor with fraud as the company faces bankruptcy. Founded to assist buyers lacking credit histories, Tricolor specialized in providing loans for used car sales, often catering to undocumented immigrants. The indictments allege that high-ranking officials, including founder and CEO Daniel Chu, orchestrated a multimillion-dollar fraudulent scheme.

Charges Against Tricolor Executives

The indictment, which emerged from the Southern District of New York, claims that Tricolor’s business model relied on extensive deceit. U.S. Attorney Jay Clayton stated, “Fraud became an integral component of Tricolor’s business strategy.” The fallout from this scheme resulted in a billion-dollar bankruptcy that affected banks, investors, employees, and customers alike.

Details of the Fraud Scheme

- Main Players: Daniel Chu (CEO), David Goodgame (COO), Jerome Kollar, and Ameryn Seibold.

- Methods of Fraud: Double-pledging collateral and other deceptive practices to mislead lenders.

- Guilty Pleas: Kollar and Seibold have admitted guilt and are cooperating with investigators.

As Tricolor faced impending collapse in August, the indictment suggests that Chu directed Kollar to authorize his $6.25 million bonus. This bonus reportedly financed a purchase of a multimillion-dollar property in Beverly Hills.

Banking Implications

Following the bankruptcy declaration, several major financial institutions that had dealings with Tricolor reported significant losses. JPMorgan Chase announced it would incur a $170 million loss linked to the company. CEO Jamie Dimon indicated there was evidence of fraud, stating that the situation might reveal more complications.

- JPMorgan Chase: $170 million loss.

- Fifth Third Bank: Estimated $200 million loss on loans linked to fraudulent activities.

Fifth Third Bank confirmed that its commercial borrower was Tricolor, and the bank has since engaged law enforcement to investigate the situation. In October, a court-appointed trustee involved in Tricolor’s bankruptcy noted the “pervasive fraud” of “extraordinary proportion,” highlighting the severity of the circumstances.

The allegations against Tricolor executives underscore a broader concern within the subprime lending market and pose significant implications for the financial industry.