Expert-Recommended Money Moves to Secure Your Finances in 2026

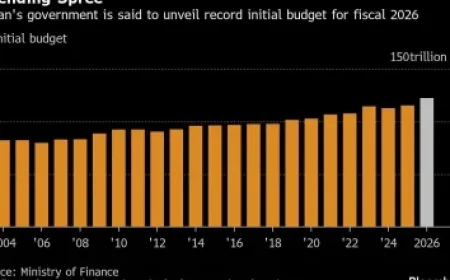

As the year 2026 approaches, many Americans face financial challenges due to the affordability crisis and stagnant wages. The rise in economic uncertainty has led many to reevaluate their financial strategies. A major tax overhaul is set to influence American finances, while potential interest rate changes by the Federal Reserve could further impact savings and investments. With 84% of Americans planning new financial resolutions for the coming year, it is crucial to implement expert-recommended money moves to secure finances in 2026.

Prepare for Tax Changes in 2026

New tax regulations, established under the Spending and Tax Bill, will come into effect on January 1, 2026. This legislation offers various deductions for seniors, workers who earn tips, and overtime employees. Key changes include:

- Tip earner deduction: Workers can deduct up to $25,000 earned in tips before December 31.

- New senior deduction: Seniors aged 65 and older may claim an additional deduction of $6,000, or $12,000 for couples, subject to income limits.

It is essential for employees to maintain accurate records of their earnings to qualify for these deductions. Understanding the modified adjusted gross income (MAGI) is key for seniors looking to claim the new deductions effectively.

Build a Realistic Budget

As inflation continues to impact incomes, creating a budget that fits personal financial habits is vital. Financial experts advise aligning budgeting methods with realistic spending patterns. The 50/30/20 rule is effective, suggesting:

- 50% of income for necessities

- 30% for lifestyle expenses

- 20% for savings and financial goals

Alternative budgeting methods, such as the envelope system and zero-based budgeting, can offer additional options to manage finances effectively. Automating savings can further aid in maintaining financial discipline.

Reduce High-Interest Debt

Paying down high-interest credit cards should be a priority. Experts recommend focusing on balances with the highest annual percentage rates (APRs) first. Strategies to manage debt include:

- Automatic payments on minimum balances.

- Using the snowball method to pay off smaller debts first for motivation.

- Considering balance transfers to 0% interest cards.

Take Advantage of Changing Interest Rates

Recent trends indicate potential interest rate cuts by the Federal Reserve in 2026. Individuals are advised to explore high-yield savings accounts and certificates of deposit (CDs) before rates possibly decrease further. Many online financial institutions currently offer attractive rates of around 4% APY.

Maximize Employer Contributions

Taking full advantage of employer-sponsored retirement savings plans is crucial. Aiming to contribute enough to receive the full company match can significantly enhance retirement savings.

- Contribute at least the minimum percentage matched by your employer, typically between 3% to 6% of your salary.

- Utilize automatic deductions to ensure consistent contributions.

Year-end contributions to a 401(k) can also lower taxable income, potentially reducing tax liability. Overall, implementing these expert-recommended money moves can help secure your finances as you step into 2026.