TSMC’s Optimistic Forecast Boosts Hopes for Long-Term AI Growth

Taiwan Semiconductor Manufacturing Company (TSMC) is set to significantly increase its capital expenditure, projecting between $52 billion and $56 billion for 2026. This forecast reflects the company’s confidence in the enduring growth of the global artificial intelligence (AI) market.

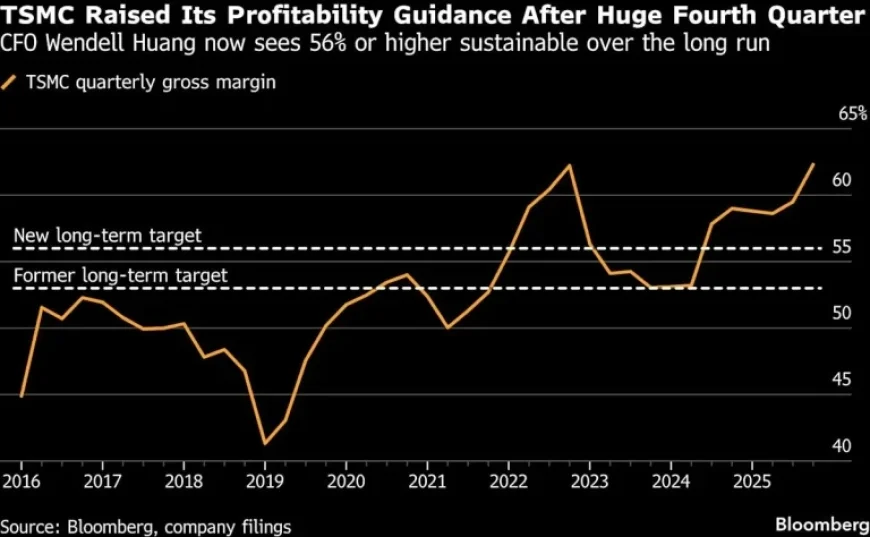

Strong Financial Performance and Growth Projections

For 2026, TSMC anticipates revenue growth of approximately 30%, surpassing analysts’ expectations. In the current year, the company expects its capital expenditures to rise by at least 25% compared to 2025. TSMC reported a net income of NT$505.7 billion, roughly $16 billion, in the last quarter of the year, showing better-than-expected earnings driven by strong sales of $33.1 billion.

Impact on Stock Market

- TSMC’s American Depositary Receipts (ADRs) rose by 5.6% in U.S. trading.

- ASML Holding NV, a key supplier, saw its shares increase by 8%, reaching a record market value exceeding $500 billion.

AI Demand and Market Strategies

TSMC’s optimistic outlook reflects a surge in demand for AI accelerators, particularly from major companies like Meta Platforms and Amazon. The company is focusing on expanding its production capacity worldwide, especially in the United States, to meet this growing demand. TSMC serves as the primary chip manufacturer for Nvidia, reinforcing its critical role in the AI ecosystem.

Concerns and Challenges

Despite its strong forecast, TSMC’s CEO, C. C. Wei, acknowledged some reservations regarding the sustainability of AI demand. The current memory chip supply crunch has raised concerns about its potential impact on consumer electronics. Macquarie Capital predicts a decline in smartphone sales by 11.6% annually due to this issue.

Future Plans and International Expansion

TSMC is also working on expanding its presence through new facilities in locations including the United States, Japan, and Germany. The company is expected to invest up to $165 billion in its U.S. operations, reflecting a commitment to enhancing production capabilities and technological advancements.

Market Insights

Industry analysts highlight TSMC’s projections as pivotal for Asian equity earnings, particularly in the context of AI’s crucial role in driving growth. The ongoing construction of AI-focused data centers, which are projected to exceed $1 trillion in investments, underscores TSMC’s strategic position in the competitive semiconductor landscape.