Ray Dalio Warns Global Order Gone; Trump Eyes Greenland Acquisition

Ray Dalio, the founder of Bridgewater Associates, recently emphasized the need for global leaders to recognize the shifting geopolitical landscape. Speaking at the World Economic Forum in Davos, Switzerland, he stated that the established global order established post-World War II has fundamentally changed. In a candid conversation with Fortune, Dalio urged a departure from the old rule-based systems.

Dalio’s Insights on the Global Order

Dalio asserted that global leaders must move beyond illusions about the enduring nature of established norms. He described the current situation as a “breakdown of the monetary order,” influenced by years of monetary policies favoring debt accumulation over sustainable economic growth.

Historical Patterns and Current Challenges

According to Dalio, the roots of today’s instability trace back to decisions made since 1971 when the United States severed the dollar’s gold backing. This marked a shift to a system where governments are more prone to “print money” rather than confront inevitable debt crises. As a result, the global economy now faces serious threats, including escalating geopolitical frictions.

Economic Shifts and Capital Wars

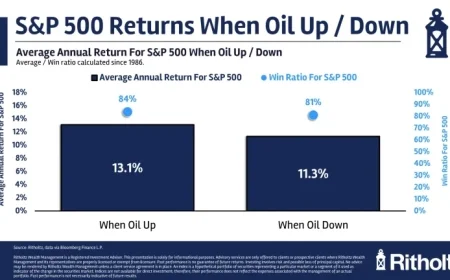

- Declining trust in U.S. Treasury bonds due to increased debt issuance.

- Growing preference for hard currencies amid international conflicts.

- Central banks reassessing their reserves—greater interest in gold.

Dalio pointed out that the U.S. market’s performance has lagged compared to foreign markets, leading to a decoupling between global currencies and U.S. debt. This changing landscape has been further complicated by political issues, including President Donald Trump’s controversial interest in acquiring Greenland.

Political Dynamics and Legal Authority

Dalio further underscored a shift from a multilateral to a unilateral world order. He questioned the efficacy of international institutions like the United Nations when major powers choose to disregard collective decisions. He observed that the decisive factor has become military and political power rather than legal statutes.

Business Implications and the Rise of Gold

Dalio’s analysis carries significant implications for businesses accustomed to relying on stable global norms. He warned that corporate leaders must wake up to the realities of a changing environment where rules may no longer guarantee protection.

As trust in traditional fiat currencies wanes, Dalio highlighted an important trend—a resurgence in the popularity of gold. He emphasized gold’s historical role as a stable reserve currency and advised investors to reconsider its place in their portfolios.

A Technological Revolution Amidst Economic Uncertainty

Despite the challenges, Dalio sees a dual landscape emerging—one where a declining monetary order coexists with a remarkable technological revolution. This viewpoint echoes sentiments expressed by Trump regarding the economic advancements taking place.

In conclusion, as the global order evolves, leaders in business and politics must adapt to an uncertain future. Awareness and realistic assessments of geoeconomic trends will be crucial in navigating this complex environment.