Gold Prices Updated: January 23, 2026

The price of gold has reached an unprecedented $4,941 per ounce as of 9:05 a.m. Eastern Time today. This significant increase of $123 from yesterday’s value and a staggering $2,171 rise from a year ago signals a dynamic shift in investor sentiment and economic conditions. With gold prices exhibiting a volatility that echoes global market uncertainties, stakeholders are reassessing their strategies regarding this traditional safe haven asset.

Current Gold Price Trends: Understanding the Market Dynamics

Today’s price movement reflects a broader trend that has seen gold surge by 2.55% from yesterday, and by an exceptional 78.38% over the past year. This striking growth can be attributed to a potent combination of enduring inflation pressures and geopolitical uncertainties, which have historically driven investors toward gold as a reliable store of value.

| Time Frame | Price | Percentage Change |

|---|---|---|

| Yesterday | $4,818 | +2.55% |

| 1 Month Ago | $4,468 | +10.59% |

| 1 Year Ago | $2,770 | +78.38% |

Market Implications: Who Stands to Gain or Lose

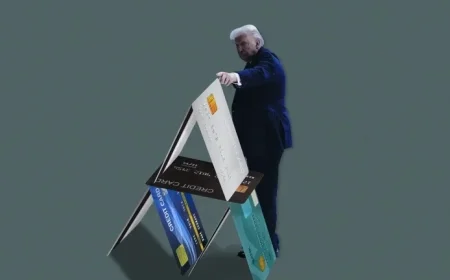

This upward trend in gold prices has profound implications for different market participants. For investors, gold is not just a commodity; it’s a strategic hedge against inflationary risks. As financial advisors advocate diversifying portfolios, gold IRAs gain popularity for their role in preserving wealth during market downturns. Yet, the dramatic appreciation also presents challenges. Investors who are heavily weighted in equities may find themselves at risk, as gold’s allure often competes against emerging technologies and robust stock performances.

The Global Ripple Effect on Investment Markets

The surge in gold prices resonates across various international markets, particularly in the U.S., UK, Canada, and Australia. In the U.S., active investment strategies are expected to pivot more toward gold as a protective measure. The UK market, historically a gold hub, may experience increased demand, reflecting traditional investment behaviors. In Canada, a country rich in natural resources, fluctuations in gold prices will impact mining sectors significantly. Similarly, in Australia, known for its substantial gold production, the economic ripples will likely persuade both local and foreign investors to rethink their portfolios.

Projected Outcomes: What Lies Ahead for Gold Investors

Looking forward, several specific trends are anticipated to shape the gold market in the coming weeks:

- Heightened Demand: Continued uncertainty surrounding inflation might prompt more investors to flock to gold, pushing prices even higher.

- Increased Regulatory Scrutiny: Governments may implement tighter regulations around gold trading as the market attracts more speculative behavior.

- Shift Towards Digital Gold: The rise of gold-backed cryptocurrencies may transform traditional investment landscapes, providing smoother access points for new investors.

The current state of the gold market reflects a confluence of economic turbulence and strategic investment shifts. As stakeholders continue to navigate high volatility, understanding the implications of these changes becomes paramount in making informed financial decisions.