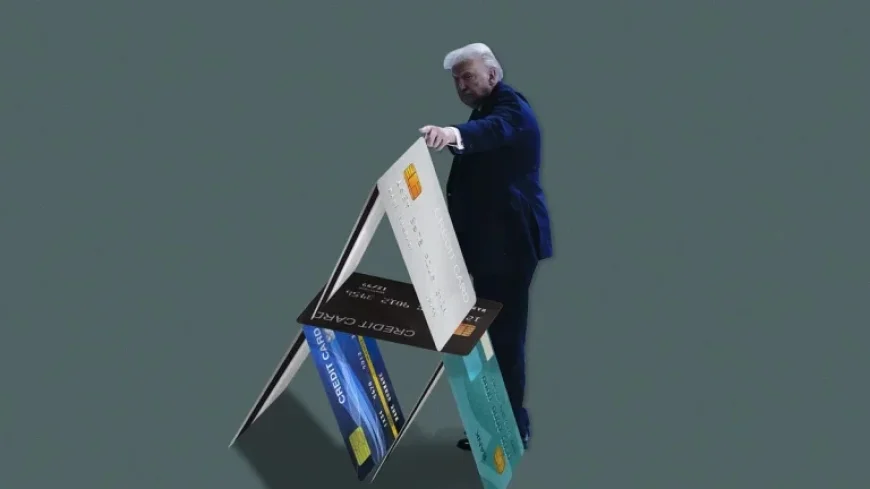

Trump’s Credit-Card Crackdown Set to Backfire

President Donald Trump marked his first year back in the White House with a controversial proposal targeting credit-card interest rates. He announced a plan to cap interest rates at 10 percent, set to begin on January 20, aimed at addressing the so-called “affordability crisis.” This announcement came through his platform, Truth Social.

Reactions to Trump’s Credit-Card Crackdown

Despite Trump’s ambitious proposal, the response from the banking sector has been overwhelmingly negative. Not a single bank has adopted this policy, nor is it expected to happen without congressional action to enforce a usury cap.

Banking Industry Responses

- Jamie Dimon: CEO of JPMorgan Chase, labeled the proposed interest rate cap as “an economic disaster.”

- Richard Fairbank: Founder and CEO of Capital One, warned that the cap could lead to a recession during a conference call.

- American Bankers Association: Voiced concerns that the plan could harm small businesses and the U.S. economy overall.

Many other bankers share similar sentiments but remain silent due to fears of potential backlash from the Trump administration.

Legal Challenges Following Criticism

The friction between Trump and some banking leaders intensified, particularly after Dimon criticized the interest rate cap. Shortly thereafter, Trump initiated a lawsuit against JPMorgan Chase and Dimon for at least $5 billion, alleging that the bank dropped him as a client following the January 6 Capitol riot.

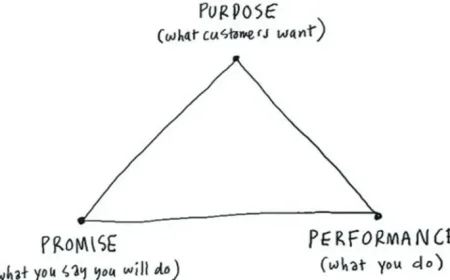

This sequence of events illustrates the complexities and interconnections between political proposals and the banking industry’s reactions. The proposed credit-card crackdown may have unintended consequences, risking strain on relations between policymakers and financial institutions.