Fed Likely to Maintain Interest Rates Amid Strong Economic Growth

The U.S. Federal Reserve is likely to maintain its current interest rates amid a robust economic backdrop. Recent surveys of economists reveal a shift towards expectations of no immediate rate cuts, contradicting earlier predictions.

Federal Reserve’s Current Rate Outlook

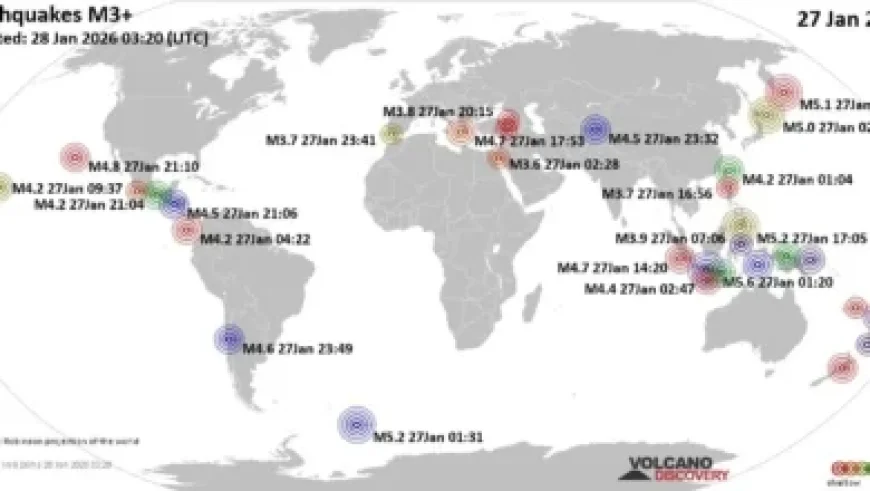

A majority of economists polled by Reuters anticipate that the Federal Reserve will keep interest rates between 3.50% and 3.75%. This decision is expected to hold steady through the Fed’s meeting scheduled for January 27-28.

- Current Rate: 3.50% to 3.75%

- Predicted Hold Period: Through the first quarter and possibly until Chair Jerome Powell’s term ends in May

- Rate Cuts Forecast: At least two anticipated later in the year

The recent economic performance supports this outlook. The U.S. economy grew at an annualized rate of 4.3% in the third quarter and is expected to expand by 2.3% in 2023. This marks an increase from an initial estimate of 2.2% last year.

Political Influence and Divided Opinions

Concerns are rising regarding potential political interference in the Fed’s independent decision-making. President Donald Trump has criticized Powell’s approach to interest rate adjustments. Furthermore, tensions have escalated about a criminal investigation surrounding Powell linked to construction at the Fed’s headquarters.

- Trump’s Criticism: Calls for more aggressive rate cuts

- Criminal Investigation: Related to Fed headquarters renovations

- Supreme Court Hearing: On the potential removal of Fed Governor Lisa Cook

Despite these controversies, a consensus on rates beyond this quarter remains elusive. However, 55 out of 100 economists foresee a resumption of rate cuts after Powell’s tenure.

Future Economic Growth and Inflation Trends

The upcoming economic landscape appears promising, with GDP growth expected to average around 2% through 2028. The Personal Consumption Expenditures index, which is the Fed’s preferred gauge for inflation, is projected to remain above the 2% target throughout the year.

- Average GDP Growth: 2% through 2028

- 2023 Growth Projection: Upgraded to 2.3%

- Unemployment Rate Estimation: Steady at approximately 4.5%

Moreover, economic expert Bernard Yaros posits that investments in artificial intelligence and recent tax cuts will substantially drive growth, predicting a GDP increase of 2.8% this year.

As the Fed navigates these complex dynamics, the anticipation of interest rate decisions and economic performance will continue to shape discussions among economists and policymakers.