Gold Prices Rise as Trump Criticizes the Dollar

The price of gold has reached a remarkable milestone, exceeding $5,300. This represents a significant rise of 3% this morning alone, as reflected by the Comex continuous contract. Year-to-date, gold prices have surged by 22.31%. Investors are increasingly turning to gold, seeking refuge from assets dragged down by the declining U.S. dollar.

Gold Prices Surge Amid Dollar Decline

Recent economic data indicates a concerning trend for the U.S. dollar, which fell 1.3% yesterday against a standard index of foreign currencies. This drop has contributed to a year-to-date decrease exceeding 2%. Current exchange rates show that one euro trades at $1.20, while the British pound is valued at $1.38. The dollar’s weakness is notable, with previous years showing more strength.

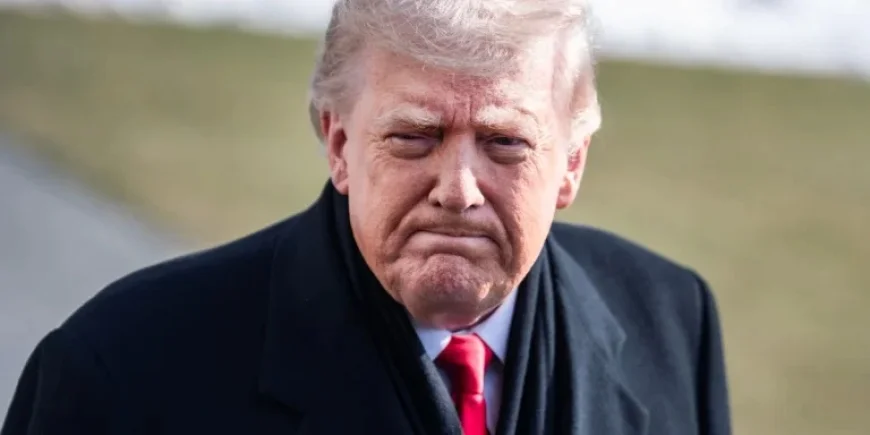

Trump’s Stance on the Dollar

U.S. President Donald Trump has expressed a rather favorable view of the dollar’s decline. When questioned by reporters, he stated, “I think it’s great,” highlighting that the current conditions may enhance the attractiveness of U.S. assets and improve export trade.

Concerns Over Reserve Currency Status

Though there are no immediate threats to the dollar’s status as the world’s reserve currency, financial experts are increasingly voicing their concerns. Paul Donovan of UBS noted that while an abrupt loss of reserve status isn’t imminent, the ongoing U.S. decline and international skepticism over key factors like rule of law could diminish its market share.

- Dollar has declined, raising concerns about its global status.

- Gold serves as an alternative safe haven for investors.

- Trade stagnation may influence perceptions of reserve currency importance.

Analyzing Investor Behavior

As the dollar struggles as a “store of value,” many investors have shifted their focus to gold. This pivot suggests a growing lack of confidence in the dollar. Meanwhile, the performance of Bitcoin contrasts sharply; despite falling gold prices, Bitcoin has not benefited, trading at $89.4K, a decline of over 13% in the past year.

Equities Response to Dollar Trends

The uncertainty surrounding the dollar has had complex implications for the U.S. equity markets. The S&P 500 achieved a new all-time high, gaining 0.41% to close at 6,978.6. Despite this rise, the day was marked by a 1% decrease in the value of dollar-denominated assets globally.

Market Snapshot: Key Indices

| Market Index | Change | Current Value |

|---|---|---|

| S&P 500 | Up 0.41% | 6,978.6 |

| STOXX Europe 600 | Down 0.43% | N/A |

| U.K. FTSE 100 | Down 0.32% | N/A |

| Japan’s Nikkei 225 | Flat | N/A |

| China’s CSI 300 | Up 0.26% | N/A |

| South Korea KOSPI | Up 1.69% | N/A |

| India’s Nifty 50 | Up 0.66% | N/A |

In conclusion, ongoing events surrounding currency fluctuations are influencing various asset classes. Investors appear to be hedging their bets on gold while keeping a cautious eye on the dollar.