“Optimize Website with Effective Down Arrow Button Icon”

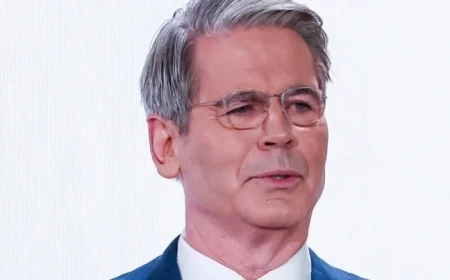

Jerome Powell, Chair of the Federal Reserve, recently made notable remarks regarding the rising prices of gold and silver. These precious metals are traditionally seen as safe-haven assets, especially during economic uncertainty. Their recent surges have drawn significant attention, given that gold has increased by 84% and silver by an unprecedented 245% year over year.

Market Reactions to Precious Metals

The current market dynamics have led to two main narratives regarding the price moves of gold and silver. Powell indicated that the Federal Reserve maintains its credibility, emphasizing that inflation expectations are consistent with the target rate of 2%. This stance contrasts with the sentiments of many investors who are increasingly considering these metals as effective hedges.

Understanding Market Sentiments

- Short-term Reactions: The “Sell America” trade reflects a reaction to unstable political conditions and policy shifts, prompting investors to reassess U.S. assets.

- Long-term Perspectives: The “debasement trade” suggests that ongoing fiscal deficits and a rising debt burden could weaken the dollar, hence driving interest in hard assets like gold.

Powell noted that fluctuations in asset prices do not necessarily indicate a fundamental loss of confidence in the U.S. economy. Instead, he argued that lasting impacts would manifest through inflation expectations rather than isolated price movements. Despite this, a record high for gold and a multiyear high for silver earlier in the week raised questions about market confidence.

Investor Concerns and Economic Interpretations

Some economists express concern, arguing that the nature of retail investment in gold has evolved. Analysts at the Bank for International Settlements suggest that retail movements may increasingly resemble speculative behavior rather than traditional safe-haven investment patterns. However, others, such as Mohamed El-Erian, emphasize that these dynamics indicate a potential loss of confidence in U.S. fiscal stewardship.

Max Belmont from First Eagle Investments encapsulated this sentiment by stating, “Gold is the inverse of confidence.” This perspective views gold as a safeguard against unforeseen inflation, market downturns, and geopolitical tensions.

Conclusion

As market trends continue to unfold, Powell’s reluctance to worry about asset price changes may be tested. The response of gold and silver markets reflects deep-seated investor anxieties and a complex interplay between economic indicators and investor psychology. Monitoring these trends will be crucial for understanding the future trajectory of U.S. financial credibility.